March 2022: Denver’s Real Estate Market Trends You Need to Know

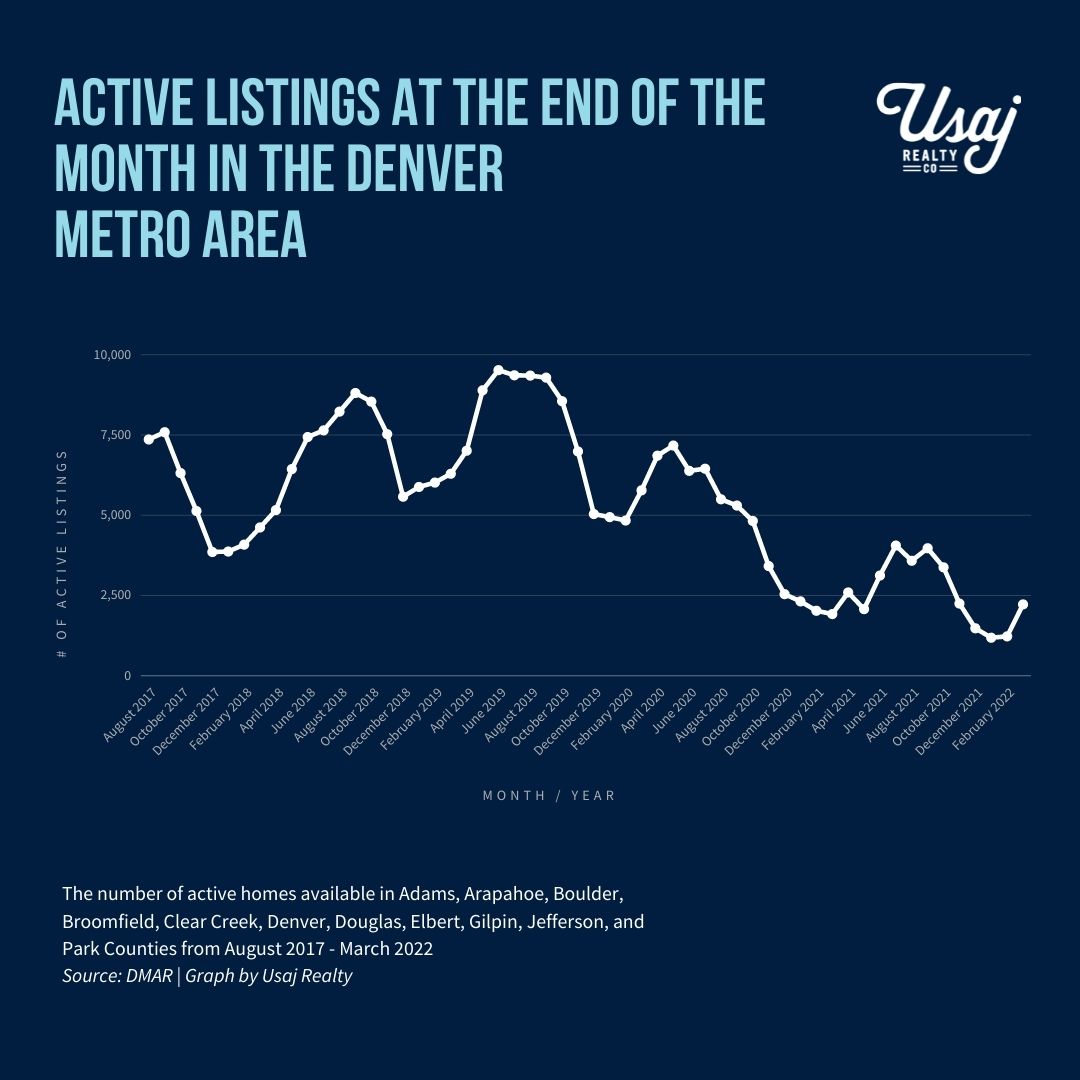

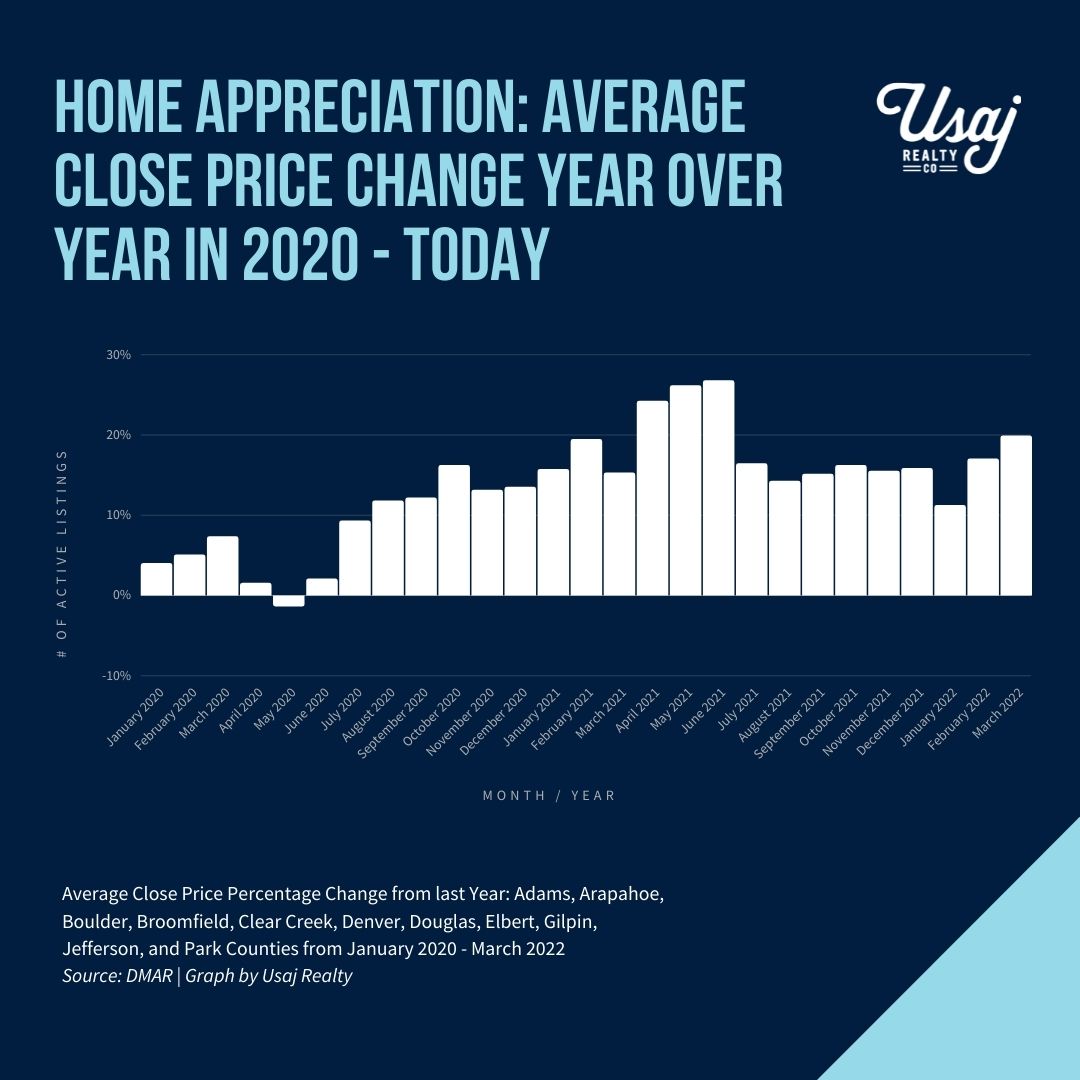

As interest rates eclipsed 4.6 percent, Denver metro’s active listings available at the end of the month increased by 81.16% over March 2022 (DMAR). We ended the month with just 2,221 active homes on the market as 5,108 homes were locked down by buyers and went under contract. The average price of a single-family detached home is currently $797,700 an increase of 18.11 percent from the same period a year ago.

So what does this mean for Denver metro homebuyers?

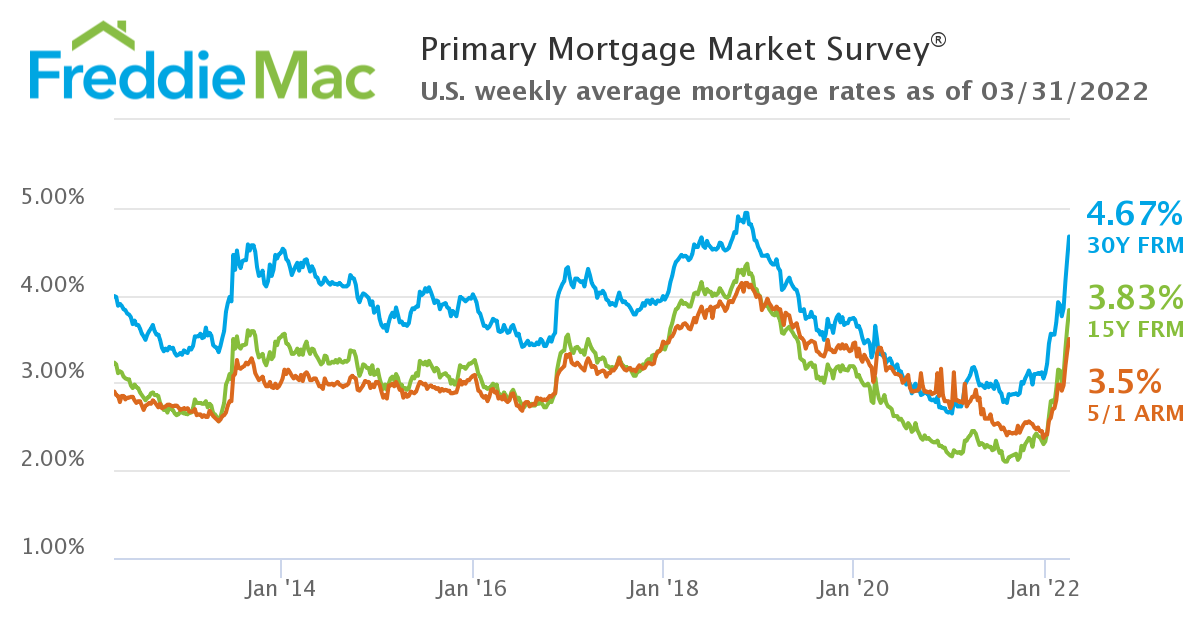

- If you wait, interest rates are going to make your purchasing power go down. For example, say you want a $2,245 monthly payment. With a 3.5% interest rate, that means you can buy a $500,000 home. With a 4.5% interest rate that number sinks to $443,119

- Renting in Denver is more expensive than ever. A recent analysis estimates the median rent in the Denver metro at $1,822 across studio up to four-bedroom apartments, making Denver metro the nation’s most expensive noncoastal rental market

- A recession does not mean we are in a housing bubble. In fact, historically the opposite is true. Looking at all U.S. recessions, except for 2008, housing actually increased in value as interest rates declined with a hurting economy

- Ultimately, in the current market, you will want to be one of the first to tour the home and one of the first offers submitted, which means your window to decide if you want to submit a strong offer is very small

- Your Usaj Realty broker will help walk you through your exact home criteria and set you up for success as you begin your home buying journey

- Really unsure where to start? Speak with a mortgage lender! They will be able to give you a breakdown of what you can afford and what you can expect to pay per month

If you are a home seller, consider selling sooner rather than later:

- Buyers are ready to buy! Denver metro had 6,020 new homes hit the market and 5,108 locking down a contract.

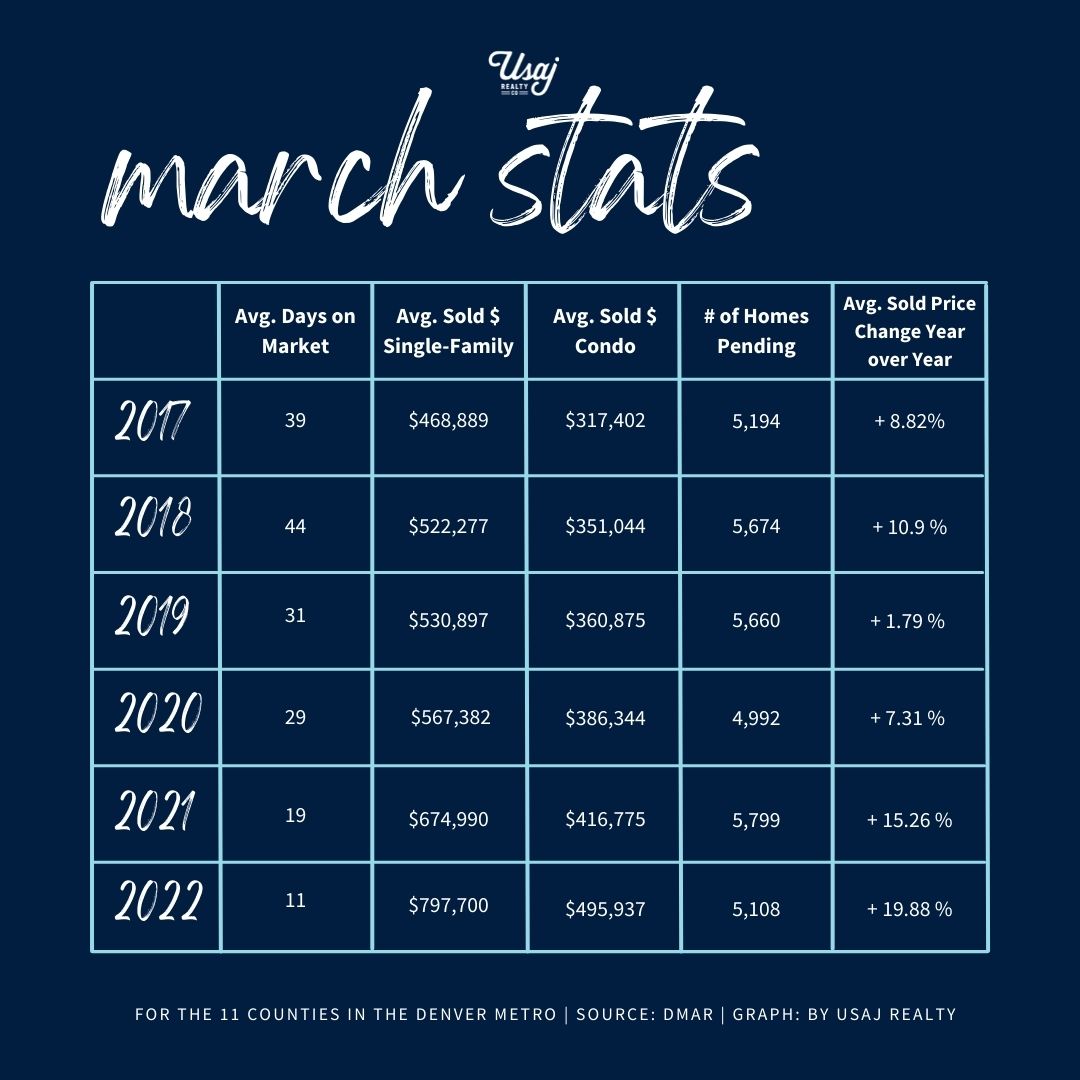

- Spring is historically a great time to list for sellers and you can expect the process to go fast: median days on market in March was a mere 4 days

- We are in an incredibly strong sellers’ market, with only a 0.53 months supply of inventory for single-family homes and 0.44 for condos. A 6 month supply is considered a balanced market

- Anything less than a 1 month of supply suggests you should have multiple offers

- Our region’s current list-to-sell ratio keeps increasing and is currently at 106.46%, meaning that the average home sold for over the asking price!

- Millennials now make up 43% of home buyers – the most of any generation – an increase from 37% last year (NAR)

- Boomers made up the largest share of home sellers at 42% (NAR)

- Your Usaj Realty broker can tell you your odds of selling and the average numbers of showings to expect in your price range and zip code

Key Quotes from DMAR:

- “With record-high sales prices, interest rates increasing north of 4.5 percent and an average close-price-to-list-price ratio of 106.46 percent, the monthly mortgage of a traditional buyer has never been higher.”

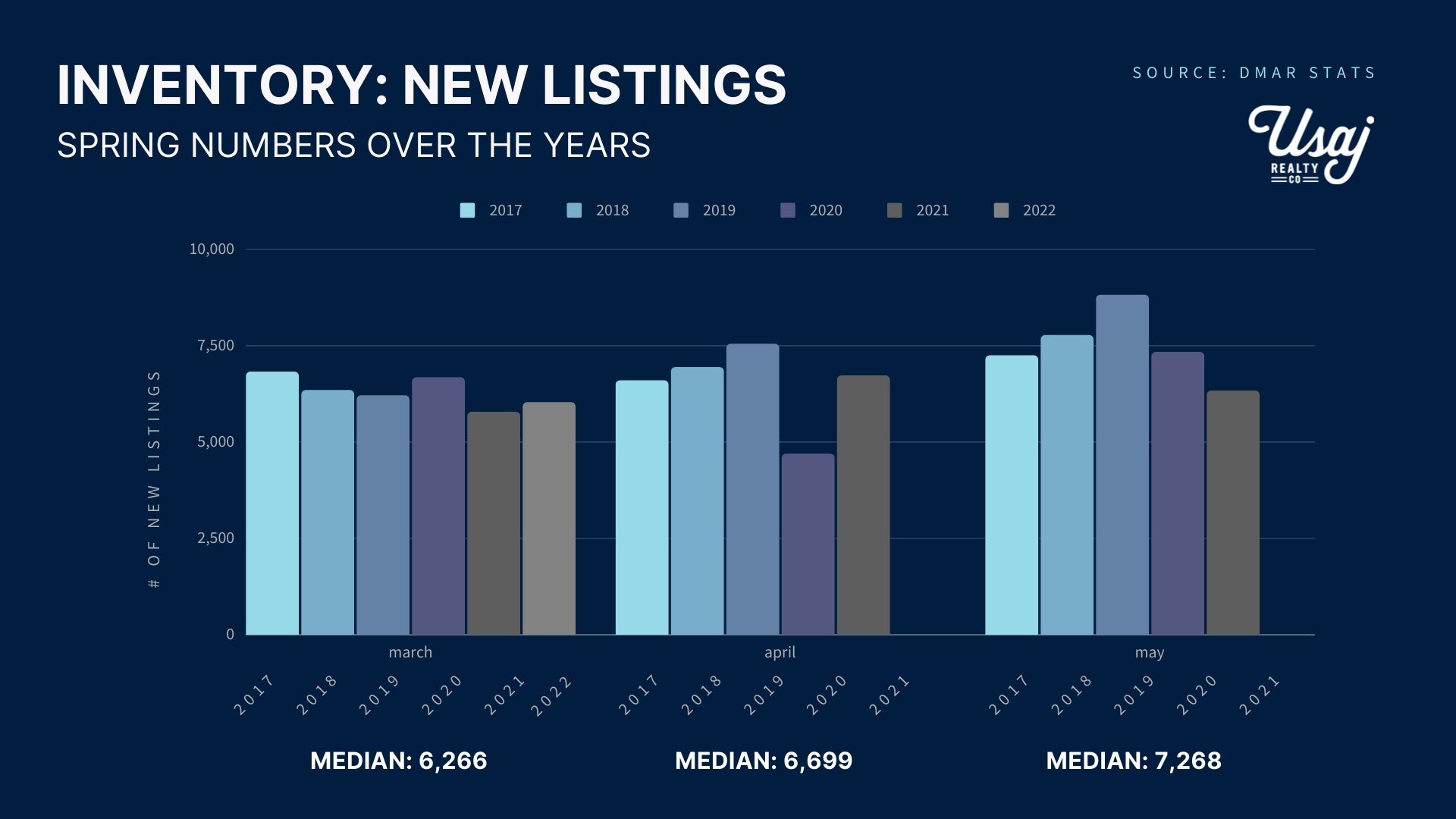

Chart: Over the past 5 years, we have seen more homes hit the market in April and then again in May. We are hopeful this will be the case again in 2022.

A quick glance at the numbers:

| Avg. Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of New Listings | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Mar. 2017 | 39 | $468,889 | $317,402 | 6,810 | 4,347 | 5,194 | + 8.82 % |

| Mar. 2018 | 44 | $522,277 | $351,044 | 6,335 | 4,213 | 5,674 | + 10.9 % |

| Mar. 2019 | 31 | $530,897 | $360,875 | 6,197 | 4,162 | 5,660 | + 1.79 % |

| Mar. 2020 | 29 | $567,382 | $386,344 | 6,663 | 4,296 | 4,992 | + 7.31 % |

| Mar. 2021 | 19 | $674,990 | $416,775 | 5,772 | 4,889 | 5,799 | + 15.26 % |

| Mar 2022 | 11 | $797,700 | $495,937 | 6,020 | 4,440 | 5,108 | + 19.88 % |

News highlights:

- “The Federal Reserve lifted its policy interest rate for the first time since 2018 and penciled in six more rate increases this year as it tries to combat a burst of quick price increases.” – New York Times

- “The Denver-Aurora-Lakewood metro area rounds out the top 10 of the best performing real estate markets over the past decade. In fact, Denver is arguably one of the finest success stories in terms of population during that period. Currently home to about 3M people, Denver has seen constant population growth over the past 10 years and is expected to boast 3.6M residents by 2030.” – Storage Cafe

- “The share of millennial home buyers increased significantly over the past year. They are also the most likely generation to use the internet to find the home they ultimately purchase and most likely to use a real estate agent.” – National Association of Realtors

- “30-year fixed-rate mortgage averaged 4.67 percent with an average 0.8 point for the week ending March 31, 2022, up from last week when it averaged 4.42 percent. A year ago at this time, the 30-year FRM averaged 3.18 percent.” – Freddie Mac

- “5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.50 percent with an average 0.3 point, up from last week when it averaged 3.36 percent. A year ago at this time, the 5-year ARM averaged 2.84 percent.” – Freddie Mac

- “The number of Americans applying for unemployment benefits last week fell to its lowest level in 53 years, the Department of Labor said on March 24.” – Axios

- “Despite recent job gains, which tend to propel the housing market forward, many uncertainties in the economy and rising prices could hamper home sales moving forward. Inflation is running high at 7.9%. Mortgage rates are expected to rise further as the Federal Reserve moves to tame its short-term interest rates.” – Realtor Magazine

Read Next: Home Buying: What to Expect When Working with Usaj Realty

During these unprecedented times, Usaj Realty would love to carefully assist you with finding your next place to call home or selling your current property. Our acumen, attention to the market, and negotiation skills will all go to work in order to advocate for your goals. Email us at info@usajrealty.com or call 720.398.2999. We measure our success by the happiness of our clients!

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!

Whether buying or selling, Usaj Realty is dedicated to helping you stay competitive. Your Usaj Realty broker will communicate effectively, learn your goals like the back of their hand, and work closely with you to negotiate the best terms possible, and expertly manage your transaction from start to finish, ensuring peace of mind.

Email us at info@usajrealty.com or call 720.398.2999