The Affordable Housing Crisis in Colorado

If one thing has been made clear this year in Colorado, it’s that housing is in crisis. According to a survey by Colorado Mesa University, the cost of housing is the number one issue facing Colorado communities today. Buyers and renters alike feel the pain when it seems the only thing being built are high-end luxury properties. Rent has risen 50 percent in Denver since 2010, and 50 percent of renters in Colorado are cost burdened — meaning they spend more than 30 percent of their household income on rent (Office of Economic Development).

Denver is in need of an additional 32,000 housing units just this year. So what is driving this shortage and what can residents do when the outlook seems so grim? Let’s take a look at the situation and the outlook for the future.

Demand Outstripping Supply

According to the U.S. Department of Housing and Urban Development, there is a need for 10 times the amount of homes currently being built. Yet, single-family homes are being built at the slowest rate in 40 years (NPR).

If so many people want houses, why aren’t they being built?

It can be most simply summed up in four reasons:

Image by Usaj Realty

All four issues come down to cost. And these four factors have their own slew of effects. For example, not enough undeveloped land means the land that is available is incredibly expensive and unobtainable for the developers who want to build affordable housing. With not enough construction workers, progress is slow and completion gets dragged out. When surveyed, 82 percent of homebuilders noted the cost of availability of labor as a significant problem (State of the Nation’s Housing, Harvard University).

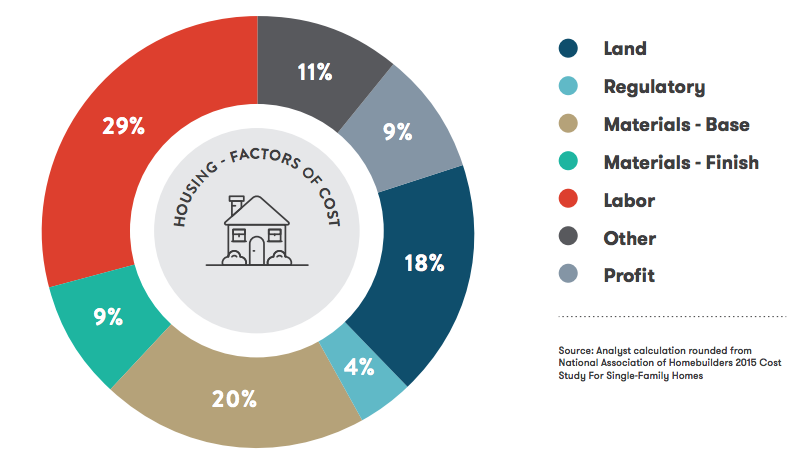

According to a report from the National Association of Homebuilders, the cost of building the average single-family home in the U.S. breaks down as follows:

Source: Shift Lab Research

During and directly following the recession, building of new homes essentially stopped. And now, 10 years later, we are suffering the consequences. The current lack of inventory allows for high prices when the projects are finally completed.

Potential Sellers Feel Trapped

According to the Federal Housing Finance Agency, homes in Colorado have appreciated 320 percent since 1990, the second-highest in the country, right behind Washington, D.C. This is wonderful news for home sellers, but it also makes navigating where to move next a tricky proposition.

As NPR aptly puts it, “Builders can’t finish homes fast enough to keep up with demand. All of this means prices for existing homes on the market are going only one direction — up, sometimes stranding people in their current homes even if they desperately want to move.”

But there are benefits to a seller’s market. “The downside of the Denver metro’s rising housing costs is obvious: a smaller and smaller percentage of residents can afford to buy a home. But for those who can, the return on investment in Denver is one of the most advantageous in the country, according to a recent survey by realtor.com…Denver was sixth on the list with an 11-percent return,” (Denver Post).

There are options sellers have in a crazy market like this one. An experienced real estate broker can walk you through your options and make sure you are aware of all the pros and cons of selling at each particular time of year.

Post-Recession Affordability in Denver

A Look Back

Before the Recession, the number of households outnumbered the number of housing units in Denver metro and construction was at an all-time high. But post-Recession, the number of additional households outpaced the number of housing units (Shift Research Lab). Prior to 2014, all of Denver’s funding for affordable housing came from the U.S. Department of Housing and Urban Development, but those funds have shrunk over the years. In 2004, Colorado received $17.3 million and in 2018 that number was down to $12 million (5280 Magazine). Luckily, in 2016, the Denver City Council “approved the first-ever dedicated fund for affordable housing in Denver,” writes the Office of Economic Development.

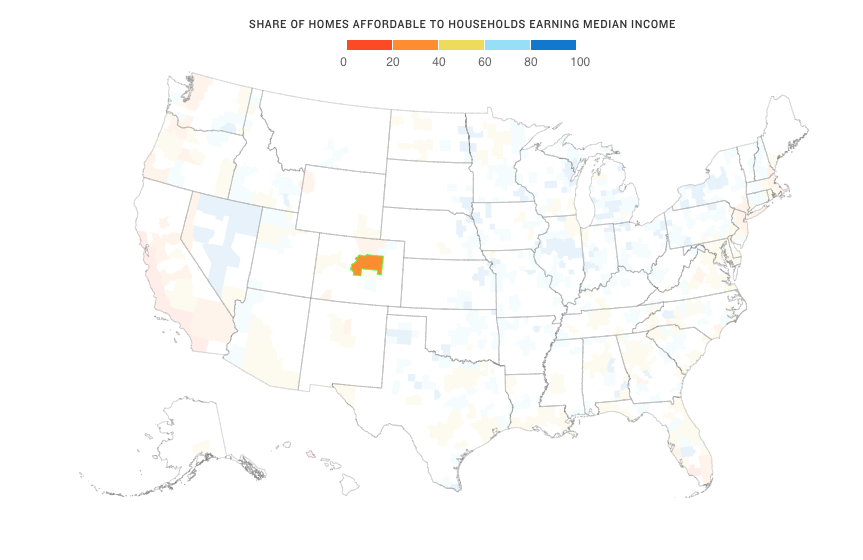

The pain is felt across the country. According to a report by Harvard University, 30 years ago, half of all homes were considered “affordable” and today, that number has been sliced to 22 percent. Plus, the lack of inventory makes prices go up further, pricing more and more people out. The National Association of Realtors reported an 11 percent drop in available single-family homes from 2016 – 2017, dropping from 1.45 million to 1.29 million.

Wages Not Keeping Up

In the Denver, Aurora, Lakewood metro area, “households earning the median income in 2016 could afford monthly payments on 31.5 percent of homes sold in the previous year,” (NPR). Compared to San Francisco’s 12.2 percent, that number seems encouraging. However, this was never an issue for Colorado pre-Recession: “Between 2001 and the onset of the Great Recession, wages in Colorado kept pace with housing costs in both the rental and ownership markets. With the recovery from the Recession, housing costs diverged upward from wages. Since 2011, Colorado wages are up 11.4 percent while Denver metro rents are up 46.2 percent and the Denver Case-Shiller index of housing prices is up 48.7 percent,” (Shift Research Lab).

The Effects of Low Paying Jobs

The number of middle-wage jobs in Colorado dropped from 68.9 percent to 63.4 percent from 2001-2015 while lower wage jobs increased in number (Shift Research Lab). This will create a dim outlook for Denver if that trend continues. According to Gary Community Investments, 39 percent of children in Colorado are living in low-income families. Furthermore, “The city’s latest estimate is that Denver has 92,000 households that are considered ‘cost burdened.’ That means they are paying more than 30 percent of their monthly incomes toward rent, a mortgage or other housing-related costs,” (Denver Post).

Source: NPR, “The New Housing Crisis: Shut Out Of The Market”

Denvers Continued Population Boom

Since 2007, Denver’s economy and quality of life has attracted approximately 31,000 new residents annually. Denver claims the second-highest spot for population growth in the country since 2010, according to the U.S. Census Bureau.

According to the State Demography Office, Colorado’s population rose 8 percent from 2010 to 2015 with 427,250 additional people. It is expected that an additional 100,000 people will move to Colorado in 2018, a repeat of last year. As the population boom continues, it creates an added strain on the already pointed issue of housing affordability.

Feeling the Squeeze

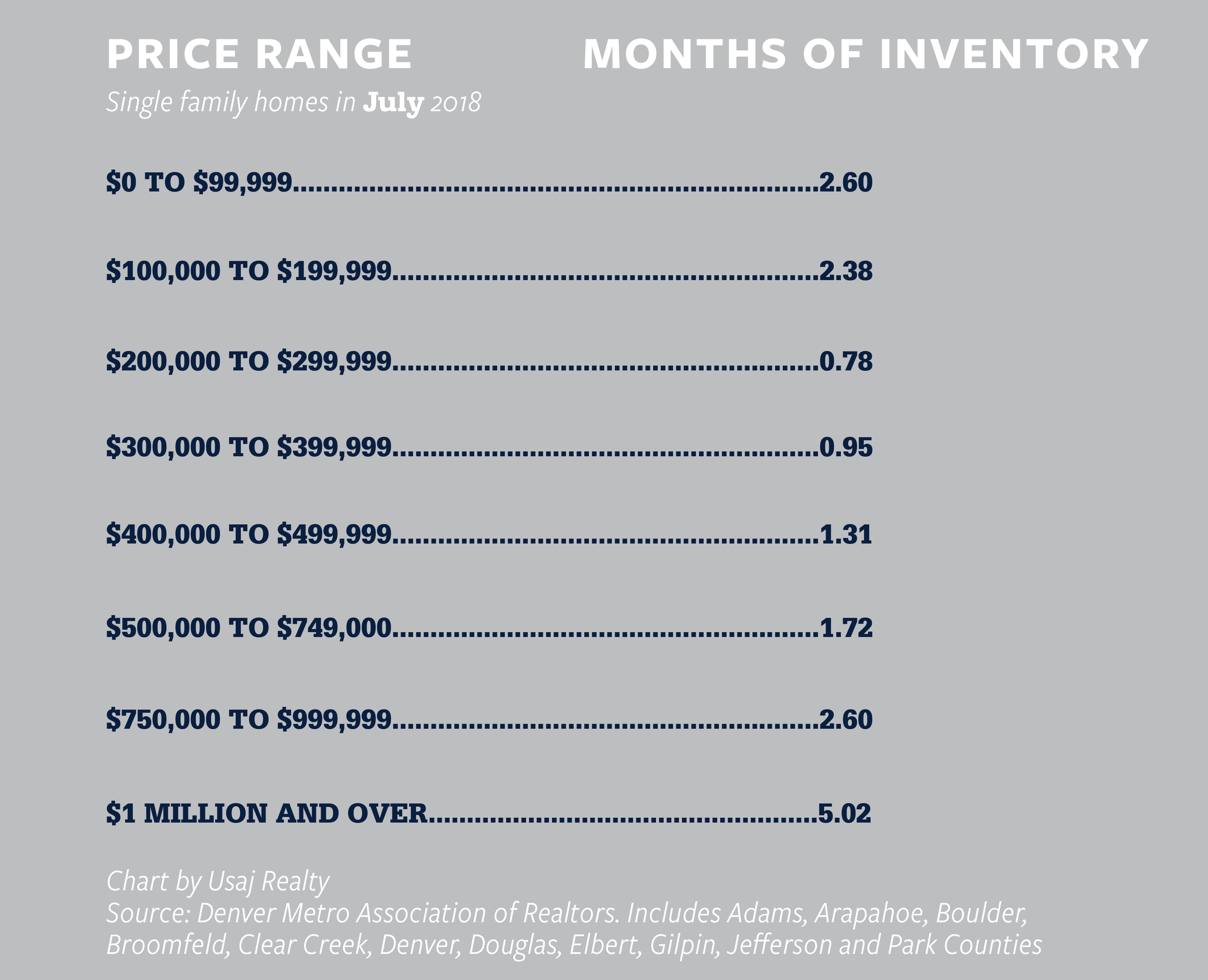

Homes priced between $200,00 and $299,999 are selling at the most aggressive rate in the Metro area. A “healthy” supply of inventory is considered six months, meaning that it would take six months to sell all of the active listings. For the $200,00 to $299,999 range, for single family homes, that inventory is currently sitting at about 0.78 months. See the complete chart below:

What are the City and State Doing to Address this Issue?

Housing Project Subsidies, Investments in Existing Buildings, and Programs to Aid Residents

Thanks to a new initiative passed by the Denver City Council, 6,244 new and preserved affordable, income-qualified housing units are expected to be available in the next decade in Denver. The money will come from raised taxes on marijuana purchases as well as the city’s general fund. The Denver Housing Authority will be able to use some of the money for redevelopment projects and land purchases that will go toward the creation and preservation of the above mentioned units (Denver Post).

The Temporary Rental and Utility Assistance Program (TRUA) and the Low-Income Energy Assistance Program are two government-funded programs that help people stay in their homes (5280 Magazine). According to the Denver Post, TRUA has helped “486 low-income households with rent assistance, averaging $1,200 apiece, and others with utility bill payment help. The second $1 million phase is expected to help about 800 households through the end of the year.”

A few projects in the works are:

- Denver Housing Authority senior housing apartment project near Sloan’s Lake

- Private developer’s apartment complex in far northeast Denver

- Spruce up the vacant First Avenue Hotel on Broadway in central Denver

- Habitat for Humanity of Metro Denver’s upcoming plan to build 32 for-sale duplex homes in Elyria-Swansea

- Low-income apartment covenants will be extended for decades for 279 units

- Program to help families who live near I-70 with the noise and dust during the highway project

- Approximately 125 households will have their rent partially covered at market-rate apartments in a pilot program

Local Hiring Requirements

There are more than 171,000 employed construction workers in Colorado, and companies are in great need of more qualified workers (CPR). This summer, the City Council approved a site-preparation contract worth $275 million requiring that the project’s construction company hire primarily from the most disadvantaged ZIP codes in Denver. It is a pilot program for the city with incredible potential. Colorado State University predicts that 30,000 new construction hires will be needed in the next five years.

Denver has $4 billion in large projects coming its way including the National Western Complex Center, Denver International Airport gate-addition and terminal renovation, and the Colorado Convention Center expansion. These projects are all potential contenders for the local hiring requirements. Furthermore, the $1.2 billion expansion of I-70 came with a goal from CDOT: hire 350 local workers (Denver Post).

Workforce Training Programs

A year ago, Colorado Department of Transportation started a training program and resource center for construction trades. A private and public partnership created WorkNow, which has successfully trained and employed 171 residents. According to the Denver Post, “The ZIP codes targeted for outreach and recruitment, based on a city analysis of income, education and unemployment data, are 80204, in Denver’s west area; 80219, to the southwest; 80223, to the south; 80205 and 80216, in the northeast; and 80236, in the far-northeast and centered on Montbello.”

How Many New Units are Coming?

With the influx of people moving to Denver post-Recession, developers began building apartment buildings at an exponential rate. “Between 2009 and 2016, apartment construction permits increased 36 percent per year. Conversely, condominium development in Colorado stagnated simultaneously as construction-defect laws enacted in 2005 only required two homeowners to form a class-action lawsuit against a builder. This current pace of rental-housing market growth is likely unsustainable over the long term,” (Business Insider).

Fortunately, in May 2017 Colorado lawmakers passed a bill that eases builders’ legal burden for construction defect issues. However, we haven’t seen a comparable condo boom like the one we saw with apartments.

Denver Infill estimates that 19,000 new residential units are coming to Downtown Denver in the next decade. In 2017, CPR reported that 25,382 residential units were under construction in the Denver area, most of these being rentals with 26,884 more in the conception and planning phase.

According to the Census Bureau, builder permits for 20,872 new housing units were approved in Colorado as of May 2018. This was an increase of 27 percent year over year. “Single family detached homes are leading the way, a good sign since that indicates product for sale rather than for rent. That’s not to say apartment, and attached housing construction is slowing. In 2018 so far, 8,348 units received approval for construction, the most since at least 2006,” (CPR).

Furthermore, as mentioned in the section above, the city is working to preserve or build 6,244 affordable units in the next decade.

Predictions for the Future

New Units Won’t be Enough to Match Demand

The study done by Shift Research Lab predicts that even with the new units coming to Denver and the reverse in the trend of single family units (as opposed to roommate situations where family units “double up”), that in 2025, the vacancy rate in Denver will be around 1.5 percent. A healthy vacancy rate for a housing market is 5%.

If supply can’t reach demand, then we won’t see a similar crash to that which caused the Great Recession. In 2006, there was an oversupply of homes. According to Realtor.com, 1.4 homes were built for every new household. Today, we only have 0.7 homes being started for every new household, causing an undersupply. A study by ApartmentList states that Denver created 2.9 jobs for every one new housing unit between 2010 and 2015. This housing shortage is felt around the nation, but is particularly painful here in Denver (read more on the bubble question here).

While growth is slowing, it is estimated about 1,000 people a month are still moving to Denver (CPR). Collaborative efforts between public and private entities will hopefully continue to get back to where we were pre-Recession.

Rent Prices May See Correction

“Slower migration, job creation and wage growth are cooling the market in 2018. Rental-housing prices will undergo a gradual correction in coming years, and landlords will experience a soft landing – not a crash,” (Business Insider). Average rent prices only increased by 1 percent in the last year, landing at $1,535. All of the newer, luxury apartment buildings in the center of Denver appear to be bringing down the cost of rent in older buildings located in less desirable neighborhoods of Denver, according to the Denver Post.

Ideas for Increasing the Supply of Houses

A multi-faceted solution is going to be the best way out of this housing crisis. For Colorado, Shift Research Lab recommends:

- Allowing for significant increases in the productivity of housing construction

- Expanding the supply of land that has development potential

- Exploring the role of social capital in all phases of housing

- Deploy strategic investments in infrastructure to increase the economic viability of less populated areas of Colorado

See their full list of recommendations on page 9 of their executive summary.

How Can Home Buyers Prevent Burnout?

Tip #1: Go Into it with Clear Expectations From the Beginning

Broker Associate Corey O’Flanagan shares what he tells his clients “I believe it is the responsibility of the real estate agent to set clear and reasonable expectations with their client. Depending on the price point, it is important to be clear that a multiple offer situation may come up and that while many people may submit offers, only one can be accepted. If people are looking for months and months and keep getting bad news, it is inevitable that their frustrations will grow and fatigue will set in. I find that addressing these situations up front helps. I try to be as clear as possible when we are working with a very competitive price point and that can help in the long run.”

Tip #2: Give Yourself Lots of Time

Kristina Casinelli, Broker Associate with Usaj Realty says, “Give yourself plenty of time for the house hunting process. This will help you make an educated decision and you won’t feel as rushed. If you start to feel burned out, take a break! Buying a home can be very emotional and it’s easy to feel overwhelmed. Keep it fresh and fun, and remember there will always be more houses. Patience and persistence is everything in this Denver market!”

If your lease is coming to an end in a few months or even if you just signed a new lease, it never hurts to meet with a Realtor and get set up on some saved searches so you can see what is coming on the market. This can help with the stress of feeling like you have to make a decision extremely fast.

Tip #3: Do Your Homework

If you are on the fence about jumping in, doing some “homework” can help prepare you. Drive around neighborhoods, visit coffee shops, attend some open houses, look online at average prices. This can help you choose a neighborhood you can afford. Of course, speaking with a qualified lender will help you find out what price point you can afford. After you have an idea of what you want, speaking with a Realtor about your ideas will then lead you to some specifics.

Tip #4: Consider Shopping in the “Off-Season”

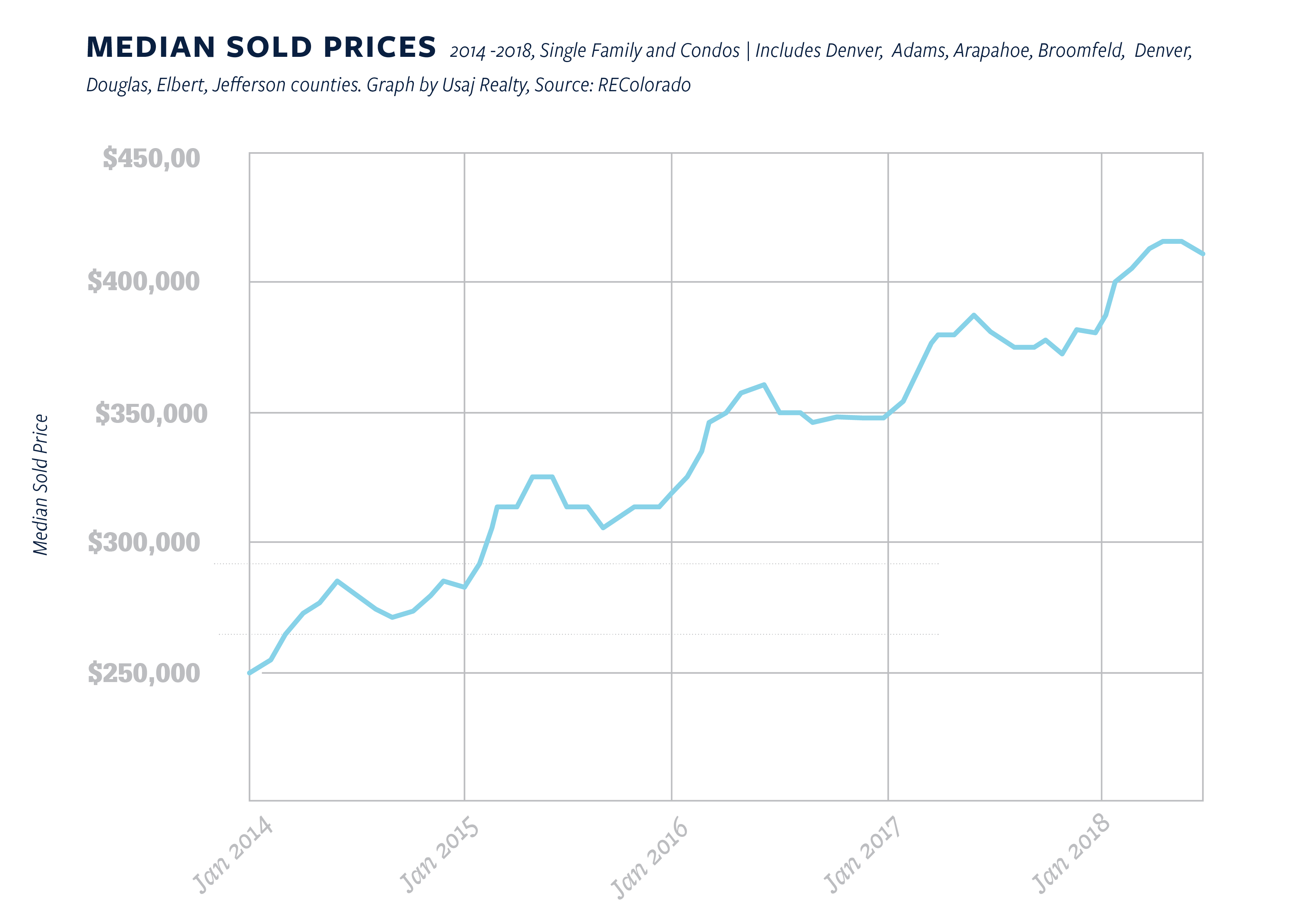

Home shopping in the “off-season” can be beneficial to buyers. There may be fewer homes to look at, but there will also be less competition and you may experience dealing with less demanding sellers (due to life events causing them to sell in winter, for example). For the last five years, prices have consistently been lowest in January and usually highest in May and June. Examine the chart below to see how the seasons affect home prices:

Tip #5: Contemplate All Your Options

Did you know that interest rates are different on a single-family home compared to a condo? And that all condos come with HOA fees? Depending on your situation, it’s important to evaluate all costs, and monthly fees and payments so you can really land the home you want. The fear of paying a monthly Private Mortgage Insurance (PMI) if you don’t have 20 percent to put down can be enough to scare some buyers off, but speaking with a lender may prove that this number is lower than you may think. They typically range between but may range between 0.3% and 1.2% of the loan amount on a yearly basis (Investopedia). Point being, if you think you are priced out of the market, consider talking to a qualified lender and learning more about all your options.

Tip #6: Choose a Realtor You Enjoy Spending Time With

Depending on your personality, you may want to choose a Realtor with whom you enjoy spending your time. The house hunt can go on for a while, so choosing someone you trust and like can be an important factor in making the home buying experience more enjoyable.

Tip #7: Choose a Realtor Who Can Negotiate Your Best Interests

Work with a Realtor who knows the market inside and out. He or she will know creative ways to put a contract together to get it accepted. They will communicate effectively with the seller’s agent in order to present the strongest offer possible. Once under contract, their professionalism plays into how smoothly the transaction will go.