What’s Driving Escalating Residential Real Estate Prices?

Skyrocketing residential home prices and low inventory have many people wondering if the housing market is in a “bubble.”

According to Investopedia, “A housing bubble, or real estate bubble, is a run-up in housing prices fueled by demand, speculation, and exuberant spending to the point of collapse.

“Housing bubbles usually start with an increase in demand, in the face of limited supply, which takes a relatively extended period to replenish and increase. Speculators pour money into the market, further driving up demand. At some point, demand decreases or stagnates at the same time supply increases, resulting in a sharp drop in prices—and the bubble bursts.”

Home Sellers Continue to Have the Upper Hand

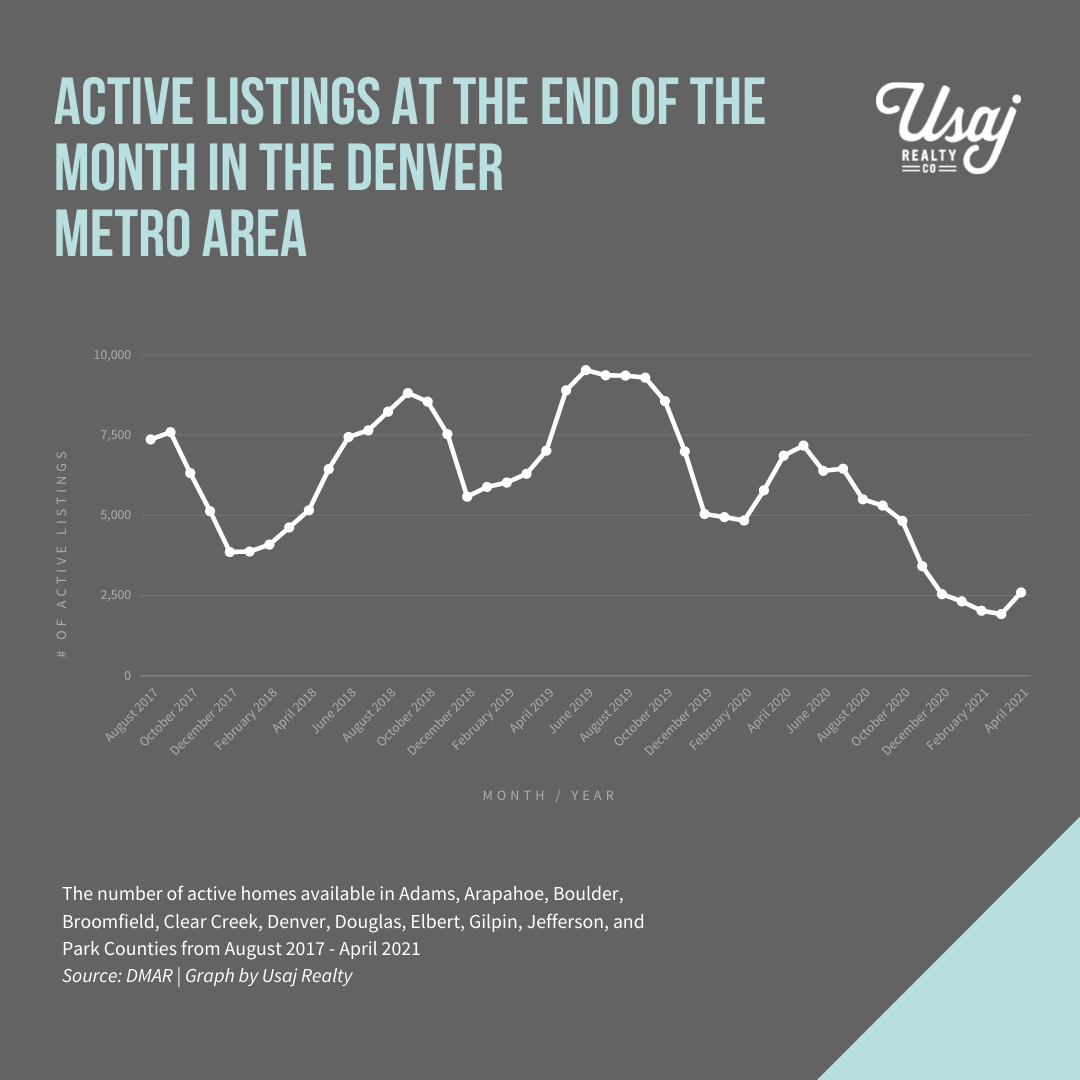

Although Denver has been a sellers’ market for at least five years, following the pandemic we have seen a dramatic increase in home values and a sharp decline in housing inventory. Single-family homes have increased in value 20 percent year-over-year and the average number of days on the market is a measly 13 days.

The median sales price for attached and detached homes was $526,000 in April. The average price of a detached single-family home is $699,039 which is $148,862 higher than last year at this time.

And the list price is usually just the starting point. Bidding wars, escalation clauses, rent back opportunities, and a litany of other incentives are presented to many home sellers.

Housing Bubble or Lack of Supply?

So are we in a housing bubble?

Some think this hot streak is proof that a bubble had indeed descended upon the real estate market. But economists aren’t so sure. According to a recent article in Realtor Magazine, housing experts are wary of the current market representing a bubble.

“We have a strong conviction that we are not experiencing a bubble in U.S. housing,” Vishwanath Tirupattur, a Morgan Stanley strategist, wrote in a note to clients earlier this month.

And the National Association of Realtors chief economist sites another factor.

Lawrence Yun, chief economist of the National Association of REALTORS®, agrees. He told Axios last month: “This is not a bubble. It is simply a lack of supply.”

Several key indicators seem to back up these assertions.

Risky Loans Aren’t Part of the Equation

Unlike the housing crisis of 2006, risky loans have not been approved for current home buyers. Fifteen years ago, lenders were approving a variety of loans including interest-only payments over an introductory period, adjustable rates, and balloon payments, all of which comprised 40 percent of the mortgage payment. Those types of loans are now at only 2 percent of the market, according to Morgan Stanley.

Also, this housing market has a record low number of homes available for sale. At the end of March, there were 1.07 million homes available for sale, according to NAR data. For comparison, during the housing bubble of 2007, there were more than four times that (4 million homes available for sale).

Record Low-Interest Rates Create Demand

Fueling the housing demand has been record-low interest rates. Months of being able to secure mortgages at less than 3 percent interest have prompted not only first-time homebuyers to jump into the market but has also kept current homeowners in their homes. By enjoying lower monthly payments and choosing to remodel/upgrade their existing residence, these property owners are reluctant to sell, upsize or downsize given how tight the market has become.

Months of being able to secure mortgages at less than 3 percent interest have prompted not only first-time homebuyers to jump into the market but has also kept current homeowners in their homes.

Low home inventory was a problem prior to the pandemic but was exacerbated during the pandemic when sawmills shut down, anticipating a slowdown in housing. As we now know, that never materialized and now, lumber prices are skyrocketing. Since October 2020, lumber prices have over tripled, causing new home prices to increase in costs by nearly $36,000 for an average single-family home.

Lumber Prices Impact New Construction

Furthermore, tariffs have impacted the amount of lumber being imported from Canada. The original tariffs were 24 percent before the Trump administration finally reduced the number to 9 percent last fall. According to CNN, the home building industry is now urging President Joe Biden to take further action. In a statement to CNN Business, NAHB Chairman Chuck Fowke called on the Biden administration to “temporarily remove” the 9% tariff on Canadian lumber “to help ease price volatility.”

While the current housing shortage is leaving would-be homebuyers frustrated and demoralized, Samuel Burman, an assistant commodities economist, predicted in the same CNN article that there will be a “sharp fall” in lumber prices over the next 18 months.

And, while existing home prices aren’t expected to keep climbing at the current pace, they aren’t projected to drop.

Fewer Foreclosures Thanks to Moratoriums

The moratorium on evictions and foreclosures as well as government aid allowed many people to stay in their homes and avoid foreclosing or being evicted when the pandemic was at its worst. According to CPR, “In the fourth quarter of 2020, foreclosure rates dropped by more than 80 percent in Colorado compared to 2019. There were 2,121 filings and 628 completed foreclosures last year, according to data from the Division of Housing.” While it is a great thing that foreclosures were prevented, this is also a major differentiating factor of how today is different from 2007.

In the meantime, the Usaj Realty team of real estate brokers stand committed to help you with all your residential real estate needs. Whether you’ve decided to list your home in order to move up in size or downsize, or are a first-time homebuyer, we have the knowledge and skills to find your dream home. Contact us today!