Pros and Cons of Overbidding

If you are a home buyer in Denver these days, it’s almost a given you’ll have to offer over the asking price on many homes. But you are probably asking yourself just “how much over asking price should I offer?”

That’s the $64,000 question these days and is the primary cause of anxiety among people hoping to go under contract.

That magic number is going to vary, depending on the appreciation rate in the home’s location, your budget, and generally how the market is moving. And your Usaj Realty Broker will help you determine the exact stats for each neighborhood as each area is going to have its unique characteristics that will have to be evaluated to determine the home’s ultimate value.

Furthermore, home values can change very rapidly. Trends from two months ago may not be applicable anymore. Having a real estate agent who can keep you up to speed on the most recent developments is extremely important in this fast-moving market.

Offering Over Asking

Knowing the appreciation rate in an area is important. It is the same as knowing company projections when you are investing in the stock market or knowing the stats before betting on your favorite sports team. Buyers in this market can make better decisions about their purchasing strategy when they have more numbers. Inventory is low and almost all neighborhoods will sell over list price if the property is priced appropriately.

That said, the appreciation rate is not the same in all areas. If you find yourself overbidding over the list price, wouldn’t you want to pay over in a neighborhood that has been increasing year or year in the double digits for over a decade? It just makes “cents” to take the time upfront and do the homework.

This market moves fast, and waiting until you find a home you like before doing the research will not work – it will be gone before the end of the day. Winning in this market is all about upfront education, and having a prepared financial strategy. Lenders have always been key players in the home buying process but today they are instrumental in getting the property under contract.

Winning in this market is all about upfront education, and having a prepared financial strategy.

What’s Your Budget?

The bottom line often lies in your budget. Buying a home is a financial commitment that in the future can pay big dividends. You have to have some cash upfront to make it work. Keep in mind you’ll need to put down a down payment, pay for a home inspection, and cover an assortment of closing costs in addition to lining up a loan (unless you’re paying cash).

Furthermore, you have to calculate property taxes, homeowner’s insurance, utility fees, HOA fees, and future home repairs and improvements into whether you can afford to bid over the asking price.

The good news is that with the current rate of appreciation, you shouldn’t have to wait too long to break even. Here are a few pros and cons to think about when determining whether you can offer the above asking price.

Pros of Overbidding on a Home:

- In this competitive market with how quickly homes are appreciating, your realtor or lender can crunch the numbers for you and see how quickly you should see an ROI.

- For example, Nicole Rueth with Fairway Mortgage displayed an example of a client paying $100,000 over asking for a $1.1M home in Denver, CO, and estimated with an appreciation rate of 5.29% per year for 5 years, the new owners would break even after 28 months.

- Your Usaj Realty Broker can give you these breakdowns specific to your situation so you can determine how much you want to overbid and make a prediction of how long it will take you to earn back your investment.

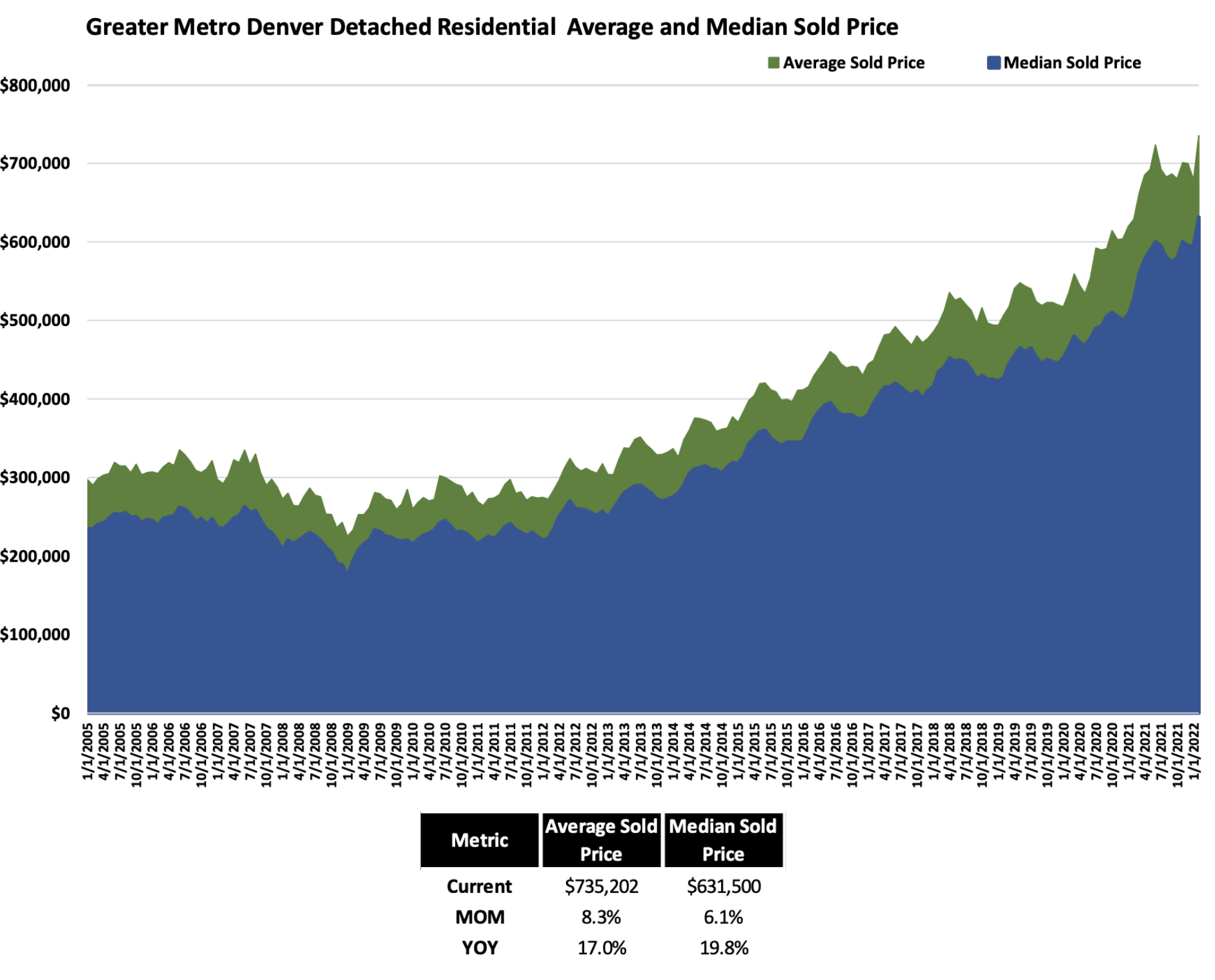

- Below is a fantastic graph made by Megan Aller with First Integrity Title on how homes have grown in price/appreciation since 2005. Even with the slight dip in prices in the 2008-2009 crash, the market rebounded with ferocity.

Cons of Overbidding on a Home:

- The home might not appraise so you’ll need to be careful about not bidding too high if you are financing the home. Otherwise, you’ll have to cover the appraisal gap (see below).

- You don’t want to offer more than you can afford each month. As mentioned earlier, homeownership is more than just a mortgage. There are many other costs that come with being a homeowner.

- There are no guarantees that homes will continue to appreciate for the amount of time you need to earn back your money in appreciation/equity.

The Appraisal Gap and What it Means to the Home Seller/Buyer

Be aware there are some situations where the appraisal price comes in lower than the agreed-upon price. This is especially true in a fast-paced sellers’ market where appraisals can’t keep up with average and median sales prices that keep rising. This appraisal gap is the difference between the appraisal and the contract price. To cover the difference, the home buyer agrees to provide cash to cover that gap.

What is Appraisal Gap Insurance and How Can it Help Your Clients?

Appraisal gap insurance is using mortgage insurance to insure your appraisal gap. If your appraisal comes back low after you overbid, there might be an option for you to increase your monthly mortgage insurance number to avoid having to cover the difference in cash. A lender will know more about your specific options with this.

Bottom Line when it comes to Overbidding

Make sure you, your lender, and your real estate agent are on the same page when it comes to making an offer above the asking price. Obtain a clear picture from your real estate agent on how homes in the area have historically appreciated. You want to feel good about your purchase and not despair about how it will impact your financial picture.