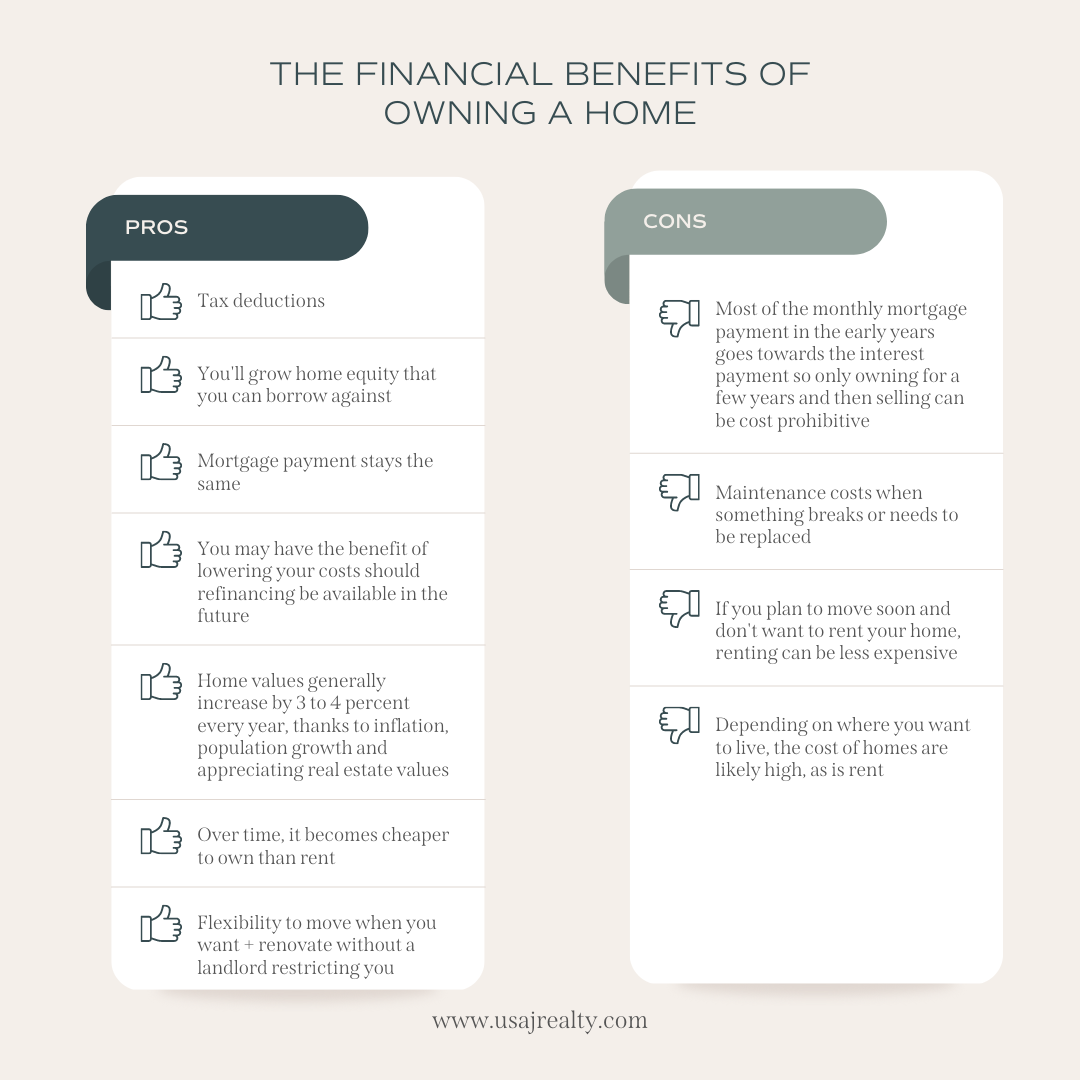

Curious about the financial benefits of being a homeowner? Read our top 6 favorite reasons why owning a home is better than renting. Everyone’s situation is going to differ and to learn more about the pros and cons, please contact one of our Usaj Realty brokers. Want to learn more about the process? Learn more about home buying here.

Tax deductions

The Tax Cuts and Jobs Act of 2017 changed some of the rules on what tax deductions are available to homeowners. The bill limits the amount of state and local tax deductions (including property taxes) to $10,000. This $10,000 limit applies for both single and married filers and is not indexed for inflation. Furthermore, homeowners lost the personal exemption.

Still, homeowners do cut their tax burden by being a homeowner.

Depending on the size of your down payment, you may be able to claim the points (if paid) on your loan and deduct them from your taxes. Mortgage points are fees paid directly to the lender at closing in exchange for a reduced interest rate. This is also called “buying down the rate,” which will most likely lower your monthly mortgage payments.

Deductions on home equity lines

You can deduct the interest you have paid on your home equity loan. Furthermore, you can switch your credit card debts to your home equity loan. Consolidating your debt is a good idea since the interest rates on a home equity loan or similar type of loan are much less than what credit card companies charge.

Capital gains exclusion

After you have lived in your home for more than 2 years and decide to sell, you can keep up to $250,000 of the profits and not owe capital gains taxes. This amount goes up to $500,000 if you are married. Keep in mind this does not apply to short-term gains and you must have lived in the home as your primary residence for more than 2 years.

You gain equity over time

Depending on your life plans and goals, it can be cheaper to buy than to rent. Over time, it becomes cheaper to own than rent, especially in cities where a high rental price would be the same price as a mortgage. However, people don’t realize that most of the monthly mortgage payment in the early years goes towards the interest payment so it is typically cheaper to own than rent as long as you hold onto the property for several years. Each situation is going to be different and an accredited lender can assist you in running numbers to determine your best options.

According to Credit Karma, on a 30-year mortgage, over 83% of the monthly payment goes to paying down interest in the first year, while only 3% of the payment is used to pay down interest in the final year. This is the primary reason why little equity is built in the first few years of a mortgage. However, with each passing year in the house, you’ll start paying down the interest on your mortgage payment and eventually will be paying off the principal and be building equity. Furthermore, if you have the means, you can pay extra each month which will help pay off the loan faster.

Lastly, rent is unpredictable over time. Tenants are at the mercy of their landlord and face the threat of yearly increases in housing costs. By owning a home, you know what your mortgage payment will be not only next month but for years to come. And you may have the benefit of lowering your costs should refinancing be available in the future.

Don’t be afraid to refinance

Once you’ve settled into your new home, remember you’re only committed to your investment, not your mortgage interest rate. Stay informed on the latest interest rates and consider refinancing your loan if the rates start to dip below what you paid. By doing so, you can often save hundreds of dollars of month. Whether you’re looking to lower your monthly payment, shorten the duration of the loan, tap into your home’s equity or consolidate debt, refinancing can be a great financial move. Don’t be afraid to reach out to a lender to determine when refinancing is appropriate for you.

Owning a home creates a solid financial base

According to the National Association of Realtors, in a strong economy, home values generally increase by 3 to 4 percent every year, thanks to inflation, natural population growth and appreciating real estate values. In November 2022, home prices went up 4.66 percent on average in the Denver metro area.

While the double-digit increases we saw during the pandemic not the norm, homeowners typically see their investment grow substantially over time and provide a solid base of wealth creation. A real estate investment is also a great way to augment your personal financial portfolio and provide a solid return when you decide to sell.

Despite higher home prices in the Denver area, it is still possible (and encouraged) to start the home buying process if you haven’t done so already. Despite rising interest rates, there are still low, favorable down payment programs in effect and a variety of loans are available to make becoming a homeowner easier than you might think.

(Editor’s note: This blog was originally published in June of 2015. It has been completely updated to reflect current trends).