Paying for College | 529 Plan is key

It’s common knowledge buying a home will most likely be the biggest purchase of your lifetime. But what comes in second? A car? A dream vacation? Not so fast, College tuition has entered the chat.

If you have kids, getting them a college education is next on the list of $$$$$ items, and it’s going to take your breath away. According to College Data, the most recent annual cost breakdown at the University of Colorado-Boulder is as follows:

Total cost: $29,215

Tuition and fees: $11,531

Room and board: $13,590

Books: $1,800

Other: $2,294

Gasp.

That’s pushing $120,000 for four years of education at an in-state university. We won’t even talk about out-of-state colleges. But before you give up all hope, there are ways to finance a college education and it’s very doable. The most important takeaway is to start as soon as possible.

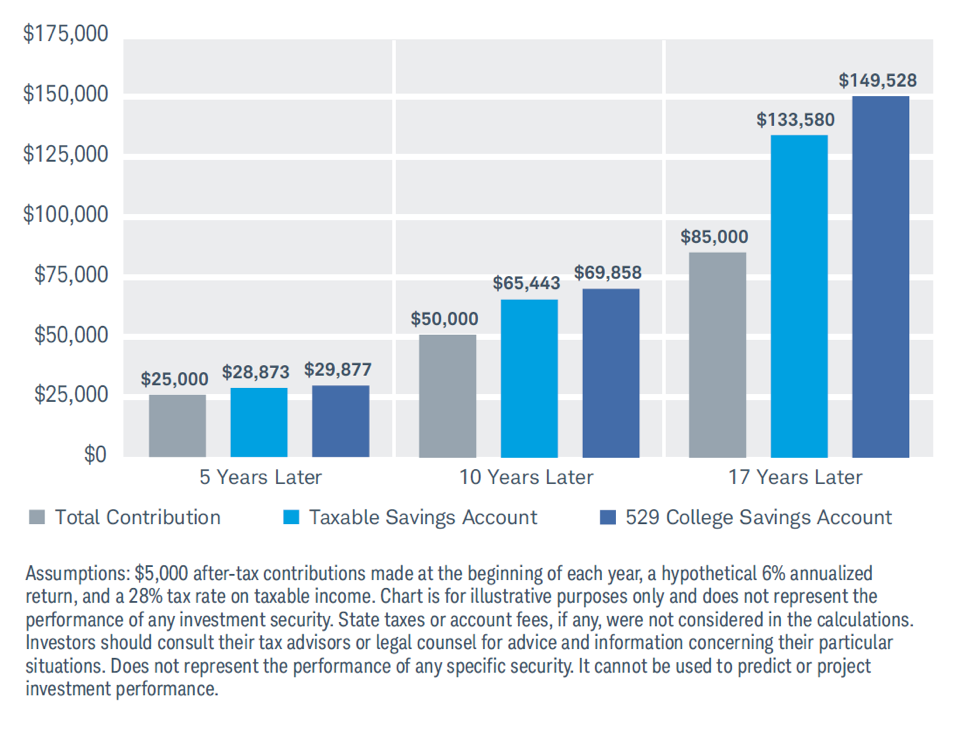

Mike Elam, Vice President – Senior Financial Consultant at Schwab, explains the most common method of paying for college education — through a tax-deferred 529 plan. Whether you make a significant one-time investment or fund a 529 with regularly scheduled contributions, the money grows exponentially with compound interest and is likely to cover the costs of a four-year education. Elam has the following observations on setting up a college fund for your children.

What are the most common funding practices for a college education?

The most common funding practices for funding college education are 529 plans and Education Savings accounts.

What should people know about a 529?

A 529 college savings plan is a state-sponsored program that allows parents, relatives and friends to invest for a child’s (or any person’s) college education. There’s no limit to how much you can contribute each year—instead, there’s a lifetime maximum, which varies by state and generally ranges upward of $400,000 per beneficiary. Earnings in a 529 college savings plan grow federally tax-deferred, which means money can compound faster because you don’t have to pay taxes on current investment income or capital gains. Qualified withdrawals are tax-free.

How does a 529 work? What are the benefits/advantages/drawbacks?

When you invest in a 529 college savings plan, you can withdraw the money tax-free to pay for qualified education expenses—tuition, books, supplies, room and board—at virtually any accredited college or university in the United States (and even some foreign schools).

Does a 529 have implications for receiving/not receiving financial aid and/or scholarship money?

Financial aid formulas consider 20% of the assets held in a child’s name available for college expenses. But a 529 plan is considered your asset, not your child’s—only 5.64% of the money is considered available for college expenses. What’s more, if the grandparents open the 529 plan, it would likely not factor into initial financial aid eligibility at all. Just be aware that this could change in the future.

In your opinion, what is the best account to establish in order to save for a college education?

Due to the high contribution limits, tax-deferred growth and tax-free qualified withdrawals, I have set up a 529 for my daughter.

Name a few common misperceptions of saving for college.

I would say that most people underestimate how much they will need for college. The education inflation rate is considerably higher than CPI and with the variables of in-state, out-of-state, public or private, parents could be surprised with how much the total cost will be.

Between 2000 and 2015, the average cost of a single year at a four-year public school—including in-state tuition, fees, and room and board—jumped nearly 70%, according to a survey by the College Board. And the price of a year at a private school rose more than 40%. That amount doesn’t even include costs like books, supplies, transportation and other expenses. Altogether, four years at a public school now costs roughly $100,000, while the bill for a private education could run to twice that amount or more.

What about using your IRA for college?

I always warn people about sacrificing their own retirement savings for their child’s education. Issues could arise down the line if the parents run out of money. Alternatives would be to work longer, save more and/or spend less, if additional college funds are needed.

Do people still use U.S. Savings Bonds?

I rarely see people using savings bonds anymore.

What are the tax benefits (if any) in setting up a savings account?

Earnings grow tax-deferred and qualified withdrawals are tax-free.

How much should people be setting aside for a college education?

There are many great calculators available that help factor in all the necessary variables. Schwab has a great one, which I have listed below:

When is the best time to start an education account?

NOW! Compound interest is a beautiful thing, so the best time to start saving is sooner rather than later.

For more information on developing a financial plan for a college education, contact Mike at 720-895-3411.