How Rising Mortgages Impact Home Affordability

Consumer prices in March jumped by 8.5% from the year prior. That marks the highest inflation rate since December of 1981 and presents further political and economic challenges for the Biden administration.

Just nine short months ago, President Biden said that inflation would be “temporary” and mortgage rates were less than 3 percent. Fast forward to today and you’ll find that addressing persistent inflation has become the Fed’s number one priority.

It’s expected that Fed Chair Jerome Powell will set in place a series of projected interest rate hikes during 2022, designed to make it more difficult/expensive to borrow money and thereby, slowing spending.

According to the Associated Press, many economists think the Fed is already acting too late. “Even as inflation has soared, the Fed’s benchmark rate is in a range of just 0.25% to 0.5%, a level low enough to stimulate growth. Adjusted for inflation, the Fed’s key rate — which influences many consumer and business loans — is deep in negative territory.

“That’s why Powell and other Fed officials have said in recent weeks that they want to raise rates “expeditiously,” to a level that neither boosts nor restrains the economy — what economists refer to as the “neutral” rate. Policymakers consider a neutral rate to be roughly 2.4%. But no one is certain what the neutral rate is at any particular time, especially in an economy that is evolving quickly.”

How will these rate increases affect the housing market, namely home affordability?

We are well into the spring months which are historically the busiest times for buying and selling homes. Keep in mind over the last two years, there has been unprecedented demand for housing and an equally extraordinary lack of home inventory.

Based on the rising mortgage rates, now over 5 percent, it’s likely many would-be home buyers will be priced out of the market. However, home inventory is still low and many people are still willing to pay more in order to achieve homeownership.

According to CNBC, home prices are still well above year-ago levels. Higher mortgage rates are also making houses less affordable. The average borrower is now paying about 38% more than they would have for the same home a year ago on a monthly payment, according to Realtor.com.

“For some buyers, general inflation and related mortgage rate hikes mean less budget flexibility to pursue freshly listed homes. For those who can afford to persist, a silver lining could be relatively less competition for more for sale home options, which could lead to some relief from relentless home price momentum.

“As more supply comes on the market and mortgage rates rise sharply, sellers appear to be coming back to Earth, at least a little. About 12% of homes for sale had a price drop during the four weeks ending April 3. That’s up from 9% a year ago, according to Redfin. The rate of sellers dropping their asking prices is now growing faster each month than it has since August.”

Higher mortgage rates force homebuyers to become ingenious

Homebuyers are increasingly becoming more creative to get around the higher mortgage rates. For example, putting down a higher down payment enables you to borrow less money and therefore, have a lower monthly payment. Also, buyers are willing to pay points in order to qualify for a lower mortgage rate. Furthermore, home buyers are considering 15-year mortgages (which offer lower rates) or even adjustable-rate mortgages, especially if they know they will be in the home for a short period of time (typically 7 years or less).

However, the bottom line is that people will be paying more for their loans compared to two months ago, which may price some people out of the home buying market. To illustrate the impact rising interest rates have on borrowers, check out the following:

In early March, a 30-year-fixed rate mortgage was around 3.75 percent; now it’s at 5.25. If someone purchased a $600,000 home with a 20 percent down payment, they would be paying around $2,687 (including principal and interest, insurance and property taxes) per month. Today, the same loan would carry an interest rate of 5.25 percent and your monthly mortgage payment would be $3,115.

The bottom line is that people will be paying more for their loans compared to two months ago, which may price some people out of the home buying market.

So what will happen to home prices as mortgage rates increase?

According to an article in the New York Times, the lack of home inventory will continue to keep home prices at lofty levels. “The problem is there are so few homes for sale that even a slower market is unlikely to create enough inventory to satisfy demand anytime soon. For years, the United States has suffered from a chronically undersupplied housing market. Homebuilding plunged after the Great Recession and remained at a recessionary pace long after the economy and job market had recovered. Even today, the pace of home building remains below the heights of the mid-2000s, before the 2008 financial crisis and housing market crash.”

Adding to the challenge are the labor shortages in the home building industry as well as supply chain issues, which have caused major delays in completing and bringing new homes to the market. Furthermore, many homeowners are unwilling to sell since many refinanced their homes when rates were below 3 percent and they have no interest in buying a new home with interest rates above 5 percent.

As a result, home prices are projected to stay high and demand will stay strong.

Home prices are projected to stay high and demand will stay strong.

Extreme homes price growth may begin to level off

According to MarketWatch, annual home growth will peak at 21.2% in May, predicts Nicole Bachaud, a Zillow economist. Bankrate.com analyst Jeff Ostrowski predicts that: “Because inventories are so low, home prices are likely to keep rising at a double-digit year-over-year pace through May. Just looking at housing trends, it seems prices will cool a bit but not significantly.”

And prices are not expected to go down any time soon. Fannie Mae forecasts that U.S. home prices will rise 10.8% this calendar year. That’s a slight downward correction from March, when Fannie Mae was predicting an 11.2% jump in home prices in 2022.

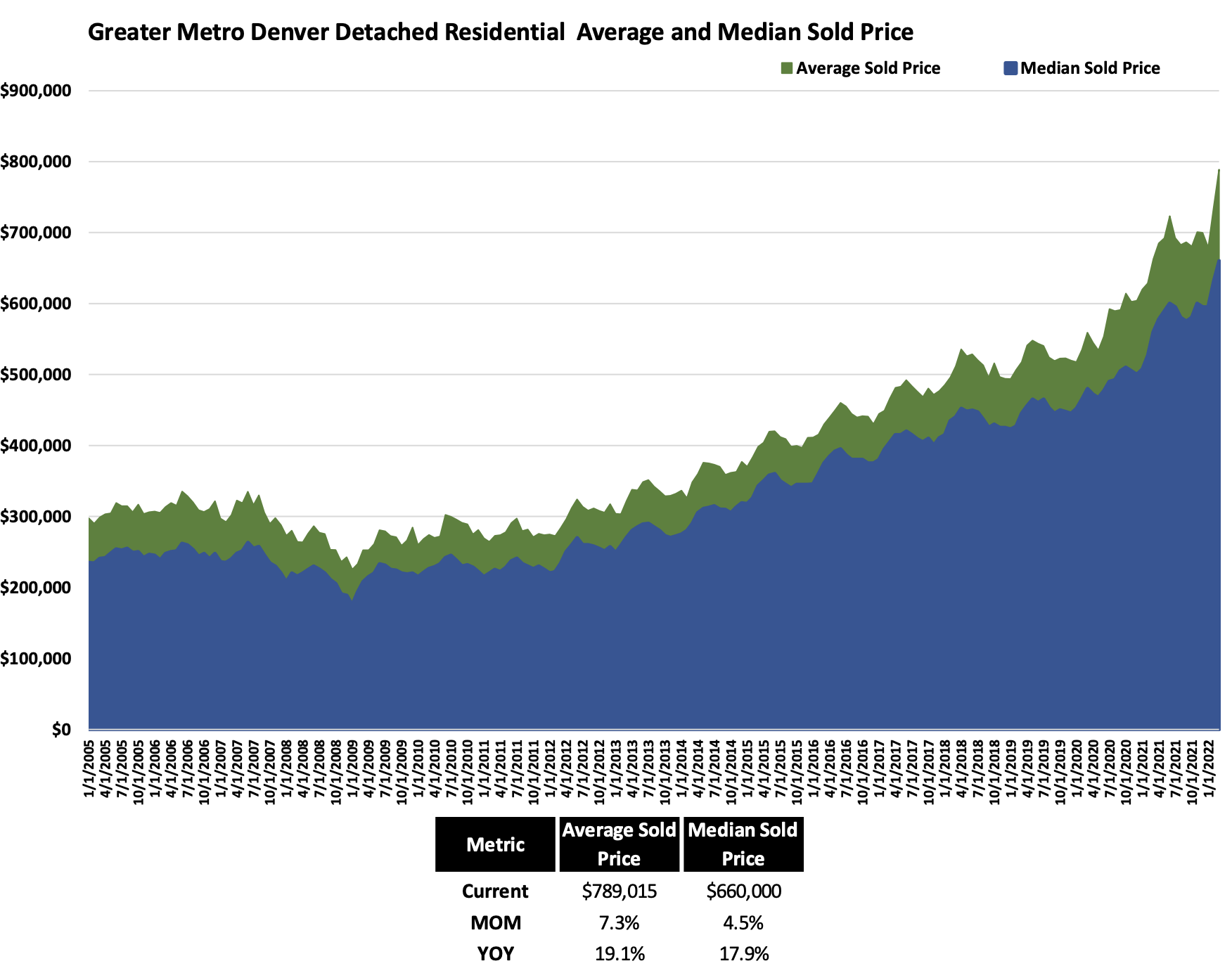

In March 2022, single-family homes in the Denver metro increased by 19.1 on average

Denver has yet to see any sort of leveling off of prices. In March 2022, single-family homes in the Denver metro increased by 19.1 on average, as Megan Aller with First American Title visualizes with the below explanatory graph on detached housing prices in the Denver Metro:

What does this mean for homebuyers?

High Prices and High Rates: Your Usaj Realty broker will help you understand if prices begin to slow their pace of acceleration. But the potential for more “deals” in the marketplace may be outweighed by a significant increase in rates. In other words, waiting for appreciation to slow its pace may not save you any money. Quite the opposite, it could ultimately cost you more, as mortgage rates continue to increase.

More Inventory and Less Competition: More inventory should be coming onto the market as we head into the later spring and early summer months. Affordability and buyer fatigue have already become a dealbreaker issue for many homebuyers as higher interest rates take hold. These factors will reduce the number of buyers shopping for a home and therefore ease up the level of competition.

At Usaj Realty, (pronounced “you say”), we believe being a homeowner is more than just owning a piece of real estate. It’s an investment in your future, a means of improving your quality of life, and the opportunity to create a true “home” that can grow your wealth for generations to come. If you are interesting in buying a home, please contact us and we’ll be happy to help with your search.