September 2019: Denver’s Real Estate Market Unveiled

See below for our full report for September 2019 and please let us know if you have any questions. We email this market infographic report on the Denver Real Estate Market each month. To get on the email list, please reach out to marketing@usajrealty.com and request to be added.

Update on the Denver Housing Market

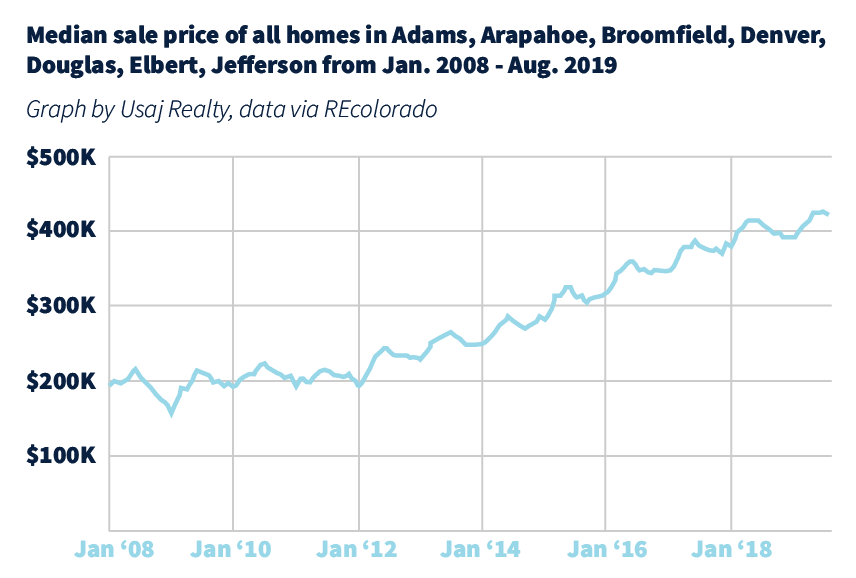

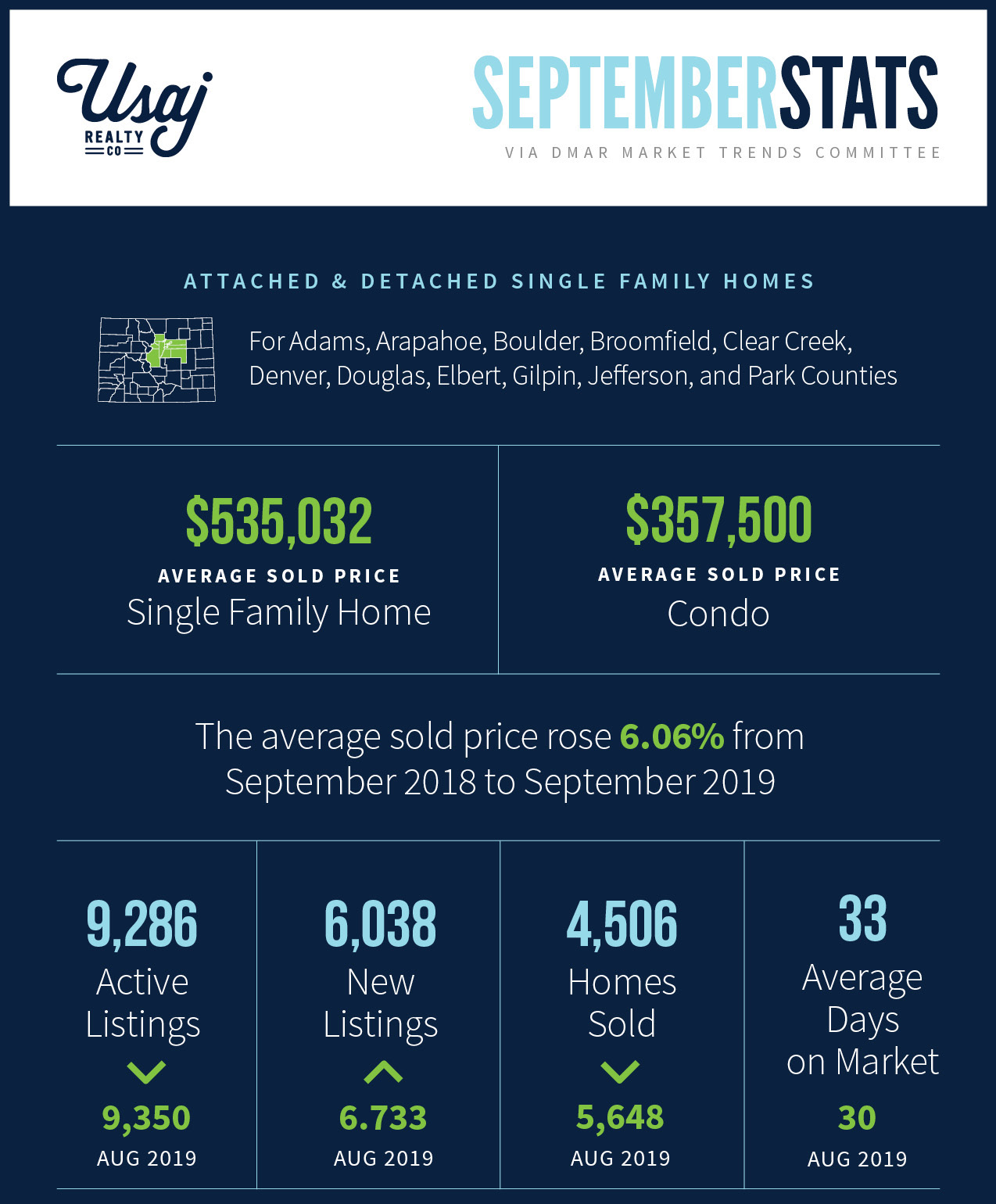

The price of homeownership in Denver increased yet again in September 2019 year-over-year but dipped just slightly when comparing the numbers to August. The average sold price for a home in metro Denver for September was $483,734, a 6.06 percent jump from September 2018 and a .56 percent decrease from August.

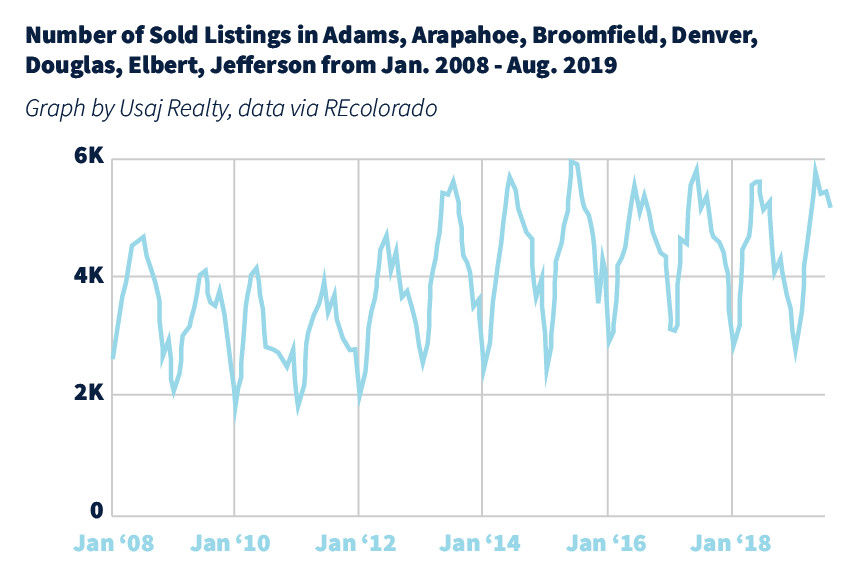

If realtors have noticed a shift in the Denver market, it may be related to the fact that demand is not as strong as it was last year, in spite of rock-bottom interest rates and increasing rent prices (DMAR reported that rent prices have gone up 74% in the last decade). The number of homes sold in September, both attached and detached homes, dropped 2.22 percent when compared to 2018, according to the report. Affordability affects demand as well. There were only 3,472 homes for sale priced between $300,000 and $499,999 in August and 3,404 in September.

Inventory went up 5.44 percent from September 2018 to 2019, and the number of days on market increased to 33, a 22.22 percent increase from September of last year.

Homebuyers are now able to afford more now than in years past. Why, you ask? Interest rates are incredibly low and will continue to be so for the foreseeable future. Wages in Denver are finally ticking up, we are experiencing relatively low inflation, and appreciation has slowed so buying may make sense now more than ever.

With low rates, higher wages, low inflation and low appreciation, in theory, a buyer can afford more house. For example, every time rates decrease by 0.25 percent, you can afford about 2.5 percent more home. Your ability to borrow $360,000 at 5 percent becomes an ability to borrow $400,000 at 4 percent. If home prices go up and interest rates increase, you might be able to buy substantially less house in five years than you can today, especially if your income doesn’t increase.

Your ability to borrow $360,000 at 5 percent becomes an ability to borrow $400,000 at 4 percent.

If and when a recession does rock the financial sectors, housing prices may not necessarily go down. According to Curbed “only twice in the last five recessions—in 1990 and 2008—did home prices come down. In 1990, prices decreased by less than a percent. During the other three, prices actually went up.”

Speaking with a qualified lender will help you determine if now is a good time for you based on things like your monthly income, down payment, credit history and what kind of monthly mortgage payment is suitable for your lifestyle.

Read next: Rent vs Buy? More Millennials are Buying Denver Homes

If you are weighing the pros and cons of buying or selling this year, a Usaj Realty broker would be happy to assist you in expertly navigating the Denver market. Many factors go into deciding what could be right for your particular situation, so sitting down with an expert can be a great opportunity to discover the best route for you.

How Sellers Can Adapt to the Shifting Market

While we are still technically in a sellers market, especially for homes priced under half a million dollars, it is still wise to adapt to the changing market if you are going to sell. DMAR reports that, “The number of price reductions has gone up. The spread between the list price and the sold price has widened. And the average days on market went up.” 37 percent of homes that sold saw a price reduction before going under contract last month. With the environment and expectations shifting in this direction, it can be a smart time to get creative with the sale of your home. Your Usaj Realty broker will walk you through this more in-depth, but if you are thinking of selling, and want to do it quickly, it can be helpful to:

- Be willing to negotiate on price

- Consider the buyers’ terms and conditions and be flexible with dates and deadlines

- Be open to a rent-back scenario if possible

- Getting a pre-inspection or be willing to work with the buyer on inspection items

- Get as much early interest as possible with a “coming soon” campaign (this means being flexible with the list date and allowing your realtor a couple weeks to get the word out prior to listing the home)

- Be sure to counter offers, even if they seem initially unreasonable. You may just be able to find a compromise

- Invest in staging and other home improvements that will attract and retain buyers

- Consider accepting a contingent offer

- Pay seller concessions

- Or, if you cannot afford any of these up-front costs, then simply price the home appropriately when you list it, knowing the new buyers are going to have to spend that time and money fixing the home

Overall just trying to remain open-minded, get creative with your realtor, choose trustworthy vendors and stay nimble.

Key takeaways for September 2019 via DMAR:

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

- Active Inventory in September 2019: 9,286

- August 2019: 9,350

- July 2019: 9,359

- June 2019: 9,520

- May 2019: 8,891

- April 2019: 7,012

- March 2019: 6,292

- February 2019: 6,017

- January 2019: 5,881

- December 2018: 5,577

- November 2018: 7,530

- October 2018: 8,539

- September 2018: 8,807

- August 2018: 8,228

- July 2018: 7,643

- June 2018: 7,436

- May 2018: 6,437

- April 2018: 5,160

- March 2018: 4,619

- February 2018: 4,084

- January 2018: 3,869

- December 2017: 3,854

- November 2017: 5,131

- October 2017: 6,312

- September 2017: 7,586

- August 2017: 7,360

- Median Sold Price for a condo in Denver metro in September 2019 was: $312,000

- August 2019: $310,000

- July 2019: $312,000

- June 2019: $310,000

- May 2019: $315,000

- April 2019: $305,000

- March 2019: $300,000

- February 2019: $297,500

- January 2019: $290,000

- December 2018: $298,225

- November 2018: $299,450

- October 2018: $299,250

- September 2018: $301,625

- August 2018: $299,000

- July 2018: $300,000

- June 2018: $305,000

- May 2018: $306,331

- April 2018: $297,000

- March 2018: $295,000

- February 2018: $296,000

- January 2018: $285,000

- December 2017: $285,000

- November 2017: $272,000

- October 2017: $275,000

- September 2017: $268,000

- August 2017 $275,000

- July 2017: $270,100

- Median Sold Price for a single-family residence in Denver metro in September 2019 was: $450,000

- August 2019: $459,900

- July 2019: $469,912

- June 2019: $465,000

- May 2019: $470,000

- April 2019: $460,000

- March 2019: $450,000

- February 2019: $430,100

- January 2019: $425,000

- December 2018: $430,000

- November 2018: $427,000

- October 2018: $435,000

- September 2018: $428,000

- August 2018: $445,000

- July 2018: $450,000

- June 2018: $452,500

- May 2018: $450,000

- April 2018: $455,000

- March 2018: $440,875

- February 2018: $435,000

- January 2018: $416,000

- December 2017: $415,000

- November 2017: $405,000

- October 2017: $415,000

- September 2017: $409,000

- August 2017: $410,000

- July 2017: $420,000

In the News: What’s Happening in Denver

For first time since 2014, the nation beat Denver in home price growth

“Denver’s been on top so long, it may not know how to be down. But in July, home prices grew 3.1 percent in metro Denver in July, according to the S&P CoreLogic Case-Shiller Index. That’s slightly below the 3.2 percent growth nationally.” – CPR

Colorado business confidence drops into negative territory for 1st time in 8 years

“Colorado business leaders’ confidence has dipped into negative territory for the first time since 2011, as mounting concerns with trade, politics and general uncertainty increasingly weigh down an economy that continues to expand, according to the latest quarterly Leeds Business Confidence Index.” – Denver Business Journal

Highest recorded median rent in Denver

“Median rent for all apartments in the City and County of Denver stood at $1,406 at the end of the first quarter of 2018, representing an increase of 4.3 percent over the end of 2017. This represents the highest ever median rent in Denver and an increase of 74 percent over the last nearly 10 years.” – DMAR

Amid warning signs, recession is not imminent

“Dubbed 2018’s best economy in the nation, Denver’s office market has bloomed since the last recession as rental rates have reached historical highs and the market has experienced positive net absorption for eight consecutive quarters.” – CREJ

In the News: What’s Happening Nationally

Families go deep in debt to stay in the middle class

“Cars, college, houses and medical care have become steadily more costly, but incomes have been largely stagnant for two decades, despite a recent uptick. Filling the gap between earning and spending is an explosion of finance into nearly every corner of the consumer economy.” – Wall Street Journal

Foreclosure starts plummet to 18-year low

“Foreclosure starts in August sank to their lowest level in more than 18 years, according to the latest First Look report from Black Knight. Foreclosure starts fell to 36,200 for the month, down more than 23% from the same time last year, the report showed. This is actually the lowest number for any single month since December 2000.” – Housing Wire

Report for September 2019:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions