Denver Housing Trends: May 2022 Market Update

Buyers Have More Choices and Negotiating Power

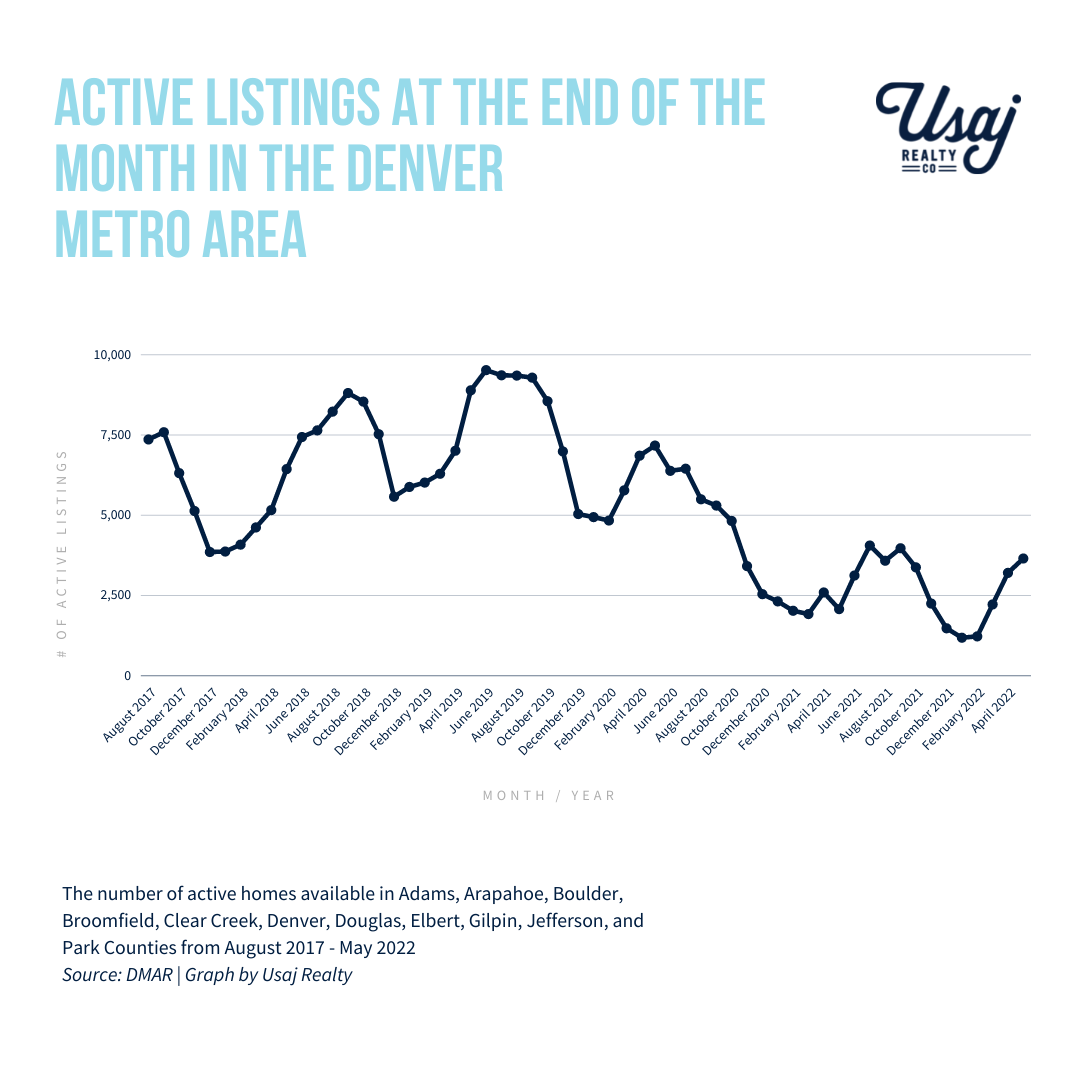

As showings have slowed down and active listings are up 76 percent year over year, buyers will start to see that they have more choices and more negotiating power. Inventory is still very low: we only have 0.73 months of inventory for single homes and 0.52 for attached homes, but the increase in mortgage rates has begun to price out a portion of eligible buyers in May 2022.

How is the market changing?

Our typical seasonal shift in the market happened early this year. What we typically see after Independence Day occurred in April: fewer home buyers hitting the pavement and more price reductions.

According to Megan Aller, “Price reductions are on the rise with 1 out of every 4 listings that went under contract last week making a price reduction at approximately -5.2% from the original price.”

In May of last year, 6,719 homes went under contract and this year, that number was down to 6,181.

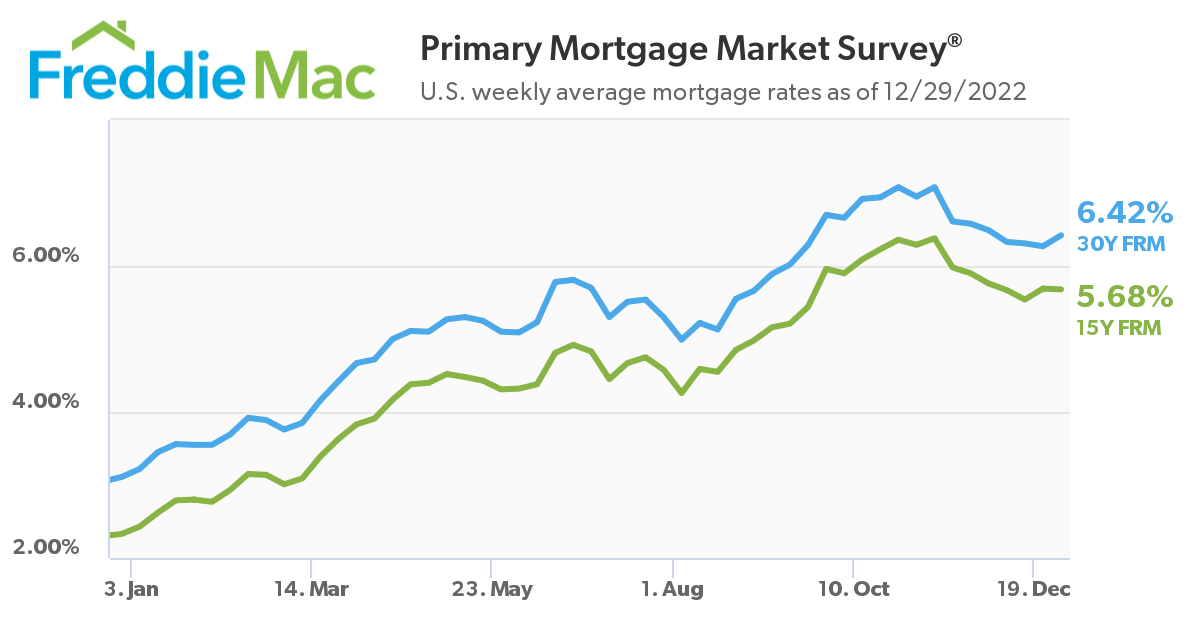

So what is causing this shift? A big factor is rising interest rates. Rates hit levels we have not seen since 2010, reaching a peak of 5.3 percent in mid-May. This puts a hefty dent in what people can afford and combined with all-time high prices, this has inevitably priced many people out of the market.

What has stayed the same? We are currently not seeing any indicators of a housing crash. For one, we still have very few homes on the market relative to demand. And the homes that are selling are doing so in a median of just 4 days, identical to May 2021. Equity is incredibly high in Colorado and across the country, putting homeowners in a good position to sell their homes if they need or want to.

According to ATTOM Data, “44.9 percent of mortgaged residential properties in the United States were considered equity-rich in the first quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their homes estimated market values.”

So what does this mean for Denver metro homebuyers?

- Prices are most likely going to remain high but you’ll have less competition

- You’ll have more choices with more inventory hitting the market now through September when listings tend to slow down (Megan Aller)

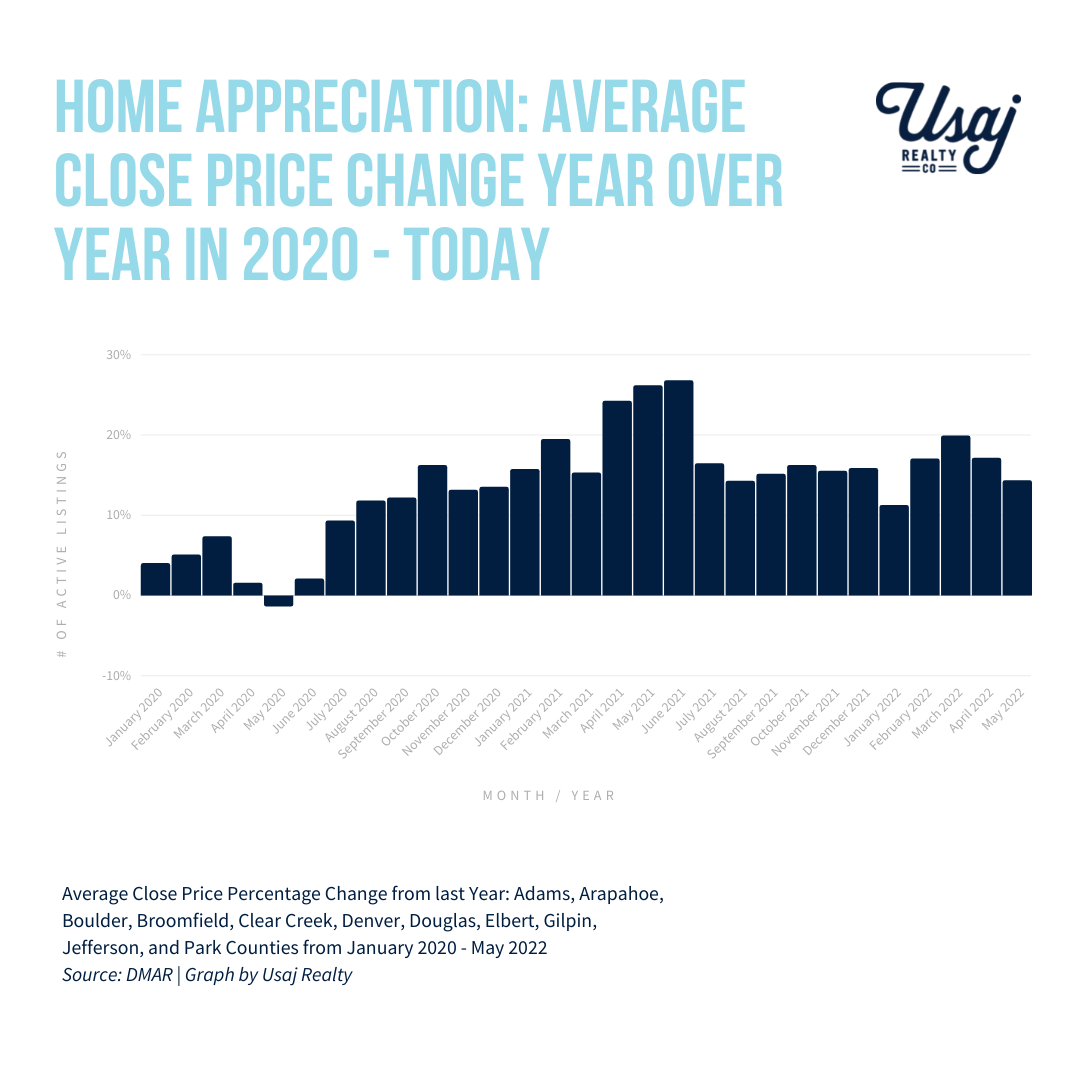

- Appreciation is going to slow down (the rate of 19 percent was unsustainable) as rents continue to rise

- Depending on the types of homes you are looking to purchase, you won’t need to write such aggressive offers as home buyers who bought homes 1-3 months ago

- Hone in on your “why” behind home shopping. Why do you want to become a homeowner and what is important to you for your long-term lifestyle and investment goals?

If I am considering listing my home, what should I know?

- Close to List came in at 105.33% telling us buyers are still paying more than asking on average.

- 8.3 percent of closed transactions in May had reduced their asking price before they locked down an offer, up from 6.9 last year.

- Rising mortgage rates will continue to slow down the pace of the market

- You can still expect to sell your home for a great price, but the competitiveness of the market is not what it was a month ago

- Appreciation is most likely going to slow down (the rate of 19+ percent was always unsustainable)

- Get really clear on the timeline that you need to sell your home by and be ready to make price reductions as needed to make that timeline a reality. If your home takes 3 weeks to sell, what does that mean for your moving timeline?

Key Quotes from Denver Metro Association of Realtors:

- “After consecutive months of appreciation, negotiations and bidding wars, modest numbers this month became a sign that the market has returned to a semblance of ‘normal.’”

- “Denver Metro’s housing market will be the story of two halves. The first of the year with unprecedented appreciation and the second half of the year with a return to normalization.”

May’s Numbers Over the Years:

| Avg. Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of New Listings | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| May 2016 | 30 | $456,018 | $300,348 | 6,788 | 4,861 | 5,857 | + 9.60% |

| May 2017 | 29 | $490,700 | $317,082 | 7,224 | 5,320 | 5,808 | + 9.83 % |

| May 2018 | 18 | $540,624 | $356,337 | 7,748 | 5,235 | 6,178 | + 11.37 % |

| May 2019 | 24 | $555,482 | $380,363 | 8,789 | 5,551 | 6,470 | + 3.36 % |

| May 2020 | 23 | $543,072 | $368,241 | 7,312 | 3,152 | 6,809 | – 1.31 % |

| May 2021 | 11 | $700,559 | $449,317 | 6,311 | 5,322 | 6,719 | + 26.13 % |

| May 2022 | 9 | $805,508 | $494,419 | 6,810 | 5,445 | 6,181 | + 14.94 % |

Source: DMAR

During these unprecedented times, Usaj Realty would love to carefully assist you with finding your next place to call home or selling your current property. Our acumen, attention to the market, and negotiation skills will all go to work in order to advocate for your goals. Email us at info@usajrealtystg.wpenginepowered.com or call 720.398.2999. We measure our success by the happiness of our clients!

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!

Whether buying or selling, Usaj Realty is dedicated to helping you stay competitive. Your Usaj Realty broker will communicate effectively, learn your goals like the back of their hand, and work closely with you to negotiate the best terms possible, and expertly manage your transaction from start to finish, ensuring peace of mind.

Email us at info@usajrealty.com or call 720.398.2999