See below for our full report for May 2019 and please let us know if you have any questions. We email this market infographic report on the Denver Real Estate Market each month. To get on the email list, please reach out to marketing@usajrealtystg.wpenginepowered.com and request to be added.

Update on the Denver Housing Market: Why is now a good time to buy?

Population growth stays consistently strong

The number of people moving to Denver increased in 2018 from 2017, with approximately 25,000 net in-migrants compared to 19,000 in 2017 (CREJ). According to the Downtown Denver Partnership, Downtown Denver saw a 13 percent increase of residents in just the past year, reaching a population of a 26,000. When you include the central Denver neighborhoods, their report found that the population has jumped to 89,000, a 10.5 percent bump from last year.

Companies continue to move to Denver

Large scale companies are continuing to move to Denver, and as long as that keeps happening, new employees will need a place to live. According to Moody’s Analytics, Denver is projected to add 69,000 “net new jobs from 2018 to 2023 and the unemployment rate will remain below 3%,” (CREJ). Experian projects an additional 33,500 renter households will be added to the marketplace from 2018 – 2023. This demand fuels steady rent prices as well as the demand for entry-level homes at affordable price points.

Tech companies are also seeing the ROI in opening offices in the Mile High City. 120 new tech companies formed in Downtown Denver in 2018, for a grand total of 724. Facebook and Amazon are among those who have made the move.

Mortgage rates remaining low

Nationally, mortgage rates are staying just over 4 percent, notably lower than 4th quarter or 2018 when they almost reached 5 percent. According to NAHB, “This lower-interest rate environment, along with ongoing job growth and rising wages, is contributing to a gradual improvement in the marketplace. At the same time, builders continue to deal with ongoing labor and lot shortages and rising material costs that are holding back supply and harming affordability.”

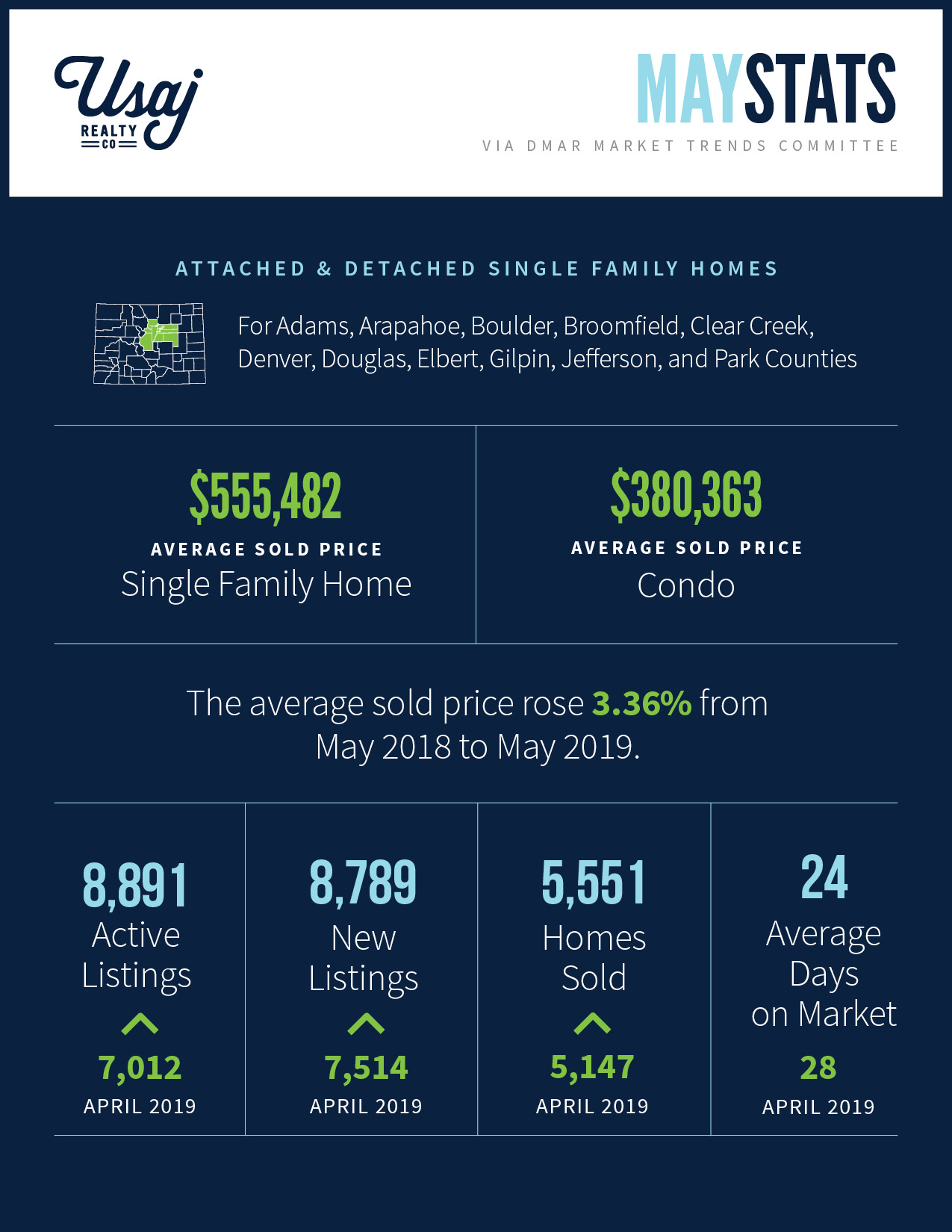

A look at the numbers from last month

For the fifth month in a row, active inventory was up. Metro Denver had 8,891 homes for sale compared to 7,012 in April. Also for the fifth month in a row, the number of homes sold and homes under contract had an increase. The number of sold homes was up to 5,551, a 10.66 percent increase from last month. And 4,724 homes went under contract.

Key Takeaways for May 2019 via DMAR

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

- Active Inventory in May 2019: 8,891

- April 2019: 7,012

- March 2019: 6,292

- February 2019: 6,017

- January 2019: 5,881

- December 2018: 5,577

- November 2018: 7,530

- October 2018: 8,539

- September 2018: 8,807

- August 2018: 8,228

- July 2018: 7,643

- June 2018: 7,436

- May 2018: 6,437

- April 2018: 5,160

- March 2018: 4,619

- February 2018: 4,084

- January 2018: 3,869

- December 2017: 3,854

- November 2017: 5,131

- October 2017: 6,312

- September 2017: 7,586

- August 2017: 7,360

- Median Sold Price for a condo in Denver metro in May 2019 was: $315,000

- April 2019: $305,000

- March 2019: $300,000

- February 2019: $297,500

- January 2019: $290,000

- December 2018: $298,225

- November 2018: $299,450

- October 2018: $299,250

- September 2018: $301,625

- August 2018: $299,000

- July 2018: $300,000

- June 2018: $305,000

- May 2018: $306,331

- April 2018: $297,000

- March 2018: $295,000

- February 2018: $296,000

- January 2018: $285,000

- December 2017: $285,000

- November 2017: $272,000

- October 2017: $275,000

- September 2017: $268,000

- August 2017 $275,000

- July 2017: $270,100

- Median Sold Price for a single-family residence in Denver metro in May 2019 was: $470,000

- April 2019: $460,000

- March 2019: $450,000

- February 2019: $430,100

- January 2019: $425,000

- December 2018: $430,000

- November 2018: $427,000

- October 2018: $435,000

- September 2018: $428,000

- August 2018: $445,000

- July 2018: $450,000

- June 2018: $452,500

- May 2018: $450,000

- April 2018: $455,000

- March 2018: $440,875

- February 2018: $435,000

- January 2018: $416,000

- December 2017: $415,000

- November 2017: $405,000

- October 2017: $415,000

- September 2017: $409,000

- August 2017: $410,000

- July 2017: $420,000

What’s Happening in Denver:

The multifamily market: Hype or the real deal?

“Denver’s relative cost of doing business is 104% (on a scale where the national average is 100%) and its relative cost of living is 113%, compared to 129% in Los Angeles, 173% in San Francisco and 120% in New York. Job growth in the market has demonstrated this trend. In the past five years, the local economy has added nearly 230,000 net jobs and downtown Denver is a hot spot. According to the Downtown Denver Partnership, 23 companies opened or relocated their offices to the central business district in the past two years and seven of these were corporate headquarters.”

“Nearly 42,000 multifamily market rate units have been built since first-quarter 2014, increasing inventory by 21% in the past five years, according to CoStar. Factoring in a glut of new supply, the current lease-up concessions offered, a rising interest rate environment and the recent volatility in the stock market, investors have cause for some concern. However, considering Colorado’s population growth and lack of entry-level homeownership units at affordable price points, investor appetite for multifamily is stronger than ever as there still is a tremendous amount of capital chasing very few deals on the market.” – CREJ

When it comes to low foreclosure rates, no state compares to Colorado

“Colorado was a leader when it came to missed mortgage payments and foreclosures in the years before the 2008 financial crisis. Now, no state can compare when it comes to borrowers who are timely on their mortgage payments and hanging onto their homes.” – Denver Post

Downtown Denver, by the numbers: 26,000 residents, 120 new tech companies, $3 billion in investment

“Downtown Denver’s decade-long economic explosion continued unabated in 2018 and the first part of 2019. More people are living in the city’s core neighborhoods than ever before. More people are working downtown than ever before.” — The Denver Post

What’s Happening Nationally:

Single-Family Permit Weakness at Start of 2019

“Over the first three months of 2019, the total number of single-family permits issued year-to-date (YTD) nationwide reached 185,336. On a year-over-year basis, this is a 7.3% decline over the March 2018 level of 199,861.” – National Association of Home Builders

The Affordable housing crisis explained

“The United States is facing an affordable housing crisis. Nearly two-thirds of renters nationwide say they can’t afford to buy a home,, and saving for that down payment isn’t going to get easier anytime soon: Home prices are rising at twice the rate of wage growth.” – Curbed

Builder Confidence Posts Solid Gain in May

“Builder confidence in the market for newly-built single-family homes rose three points to 66 in May, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Builder sentiment is at its highest level since October 2018 after declines in late 2018 due to higher interest rates and concerns over slower growth. Builders are catching up after a wet winter and many characterize sales as solid, driven by improved demand and ongoing low overall supply. However, affordability challenges persist.”

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!