March 2020: Denver Real Estate Trends You Need to Know

Update on the Denver Housing Market

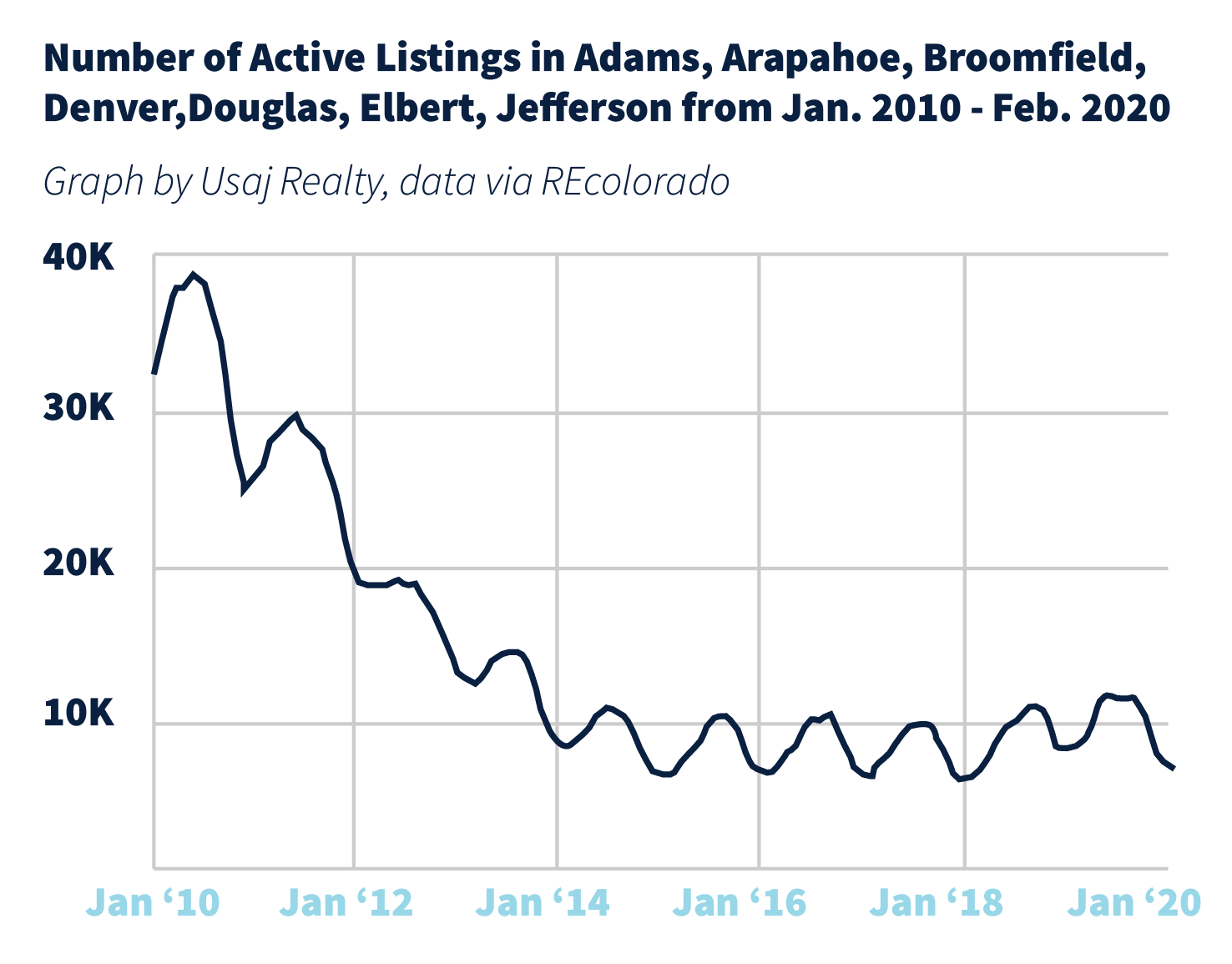

The start of 2020 had Denver’s housing market in March 2020 off to an incredibly hot start. Inventory was low and demand was high, and more homes sold and for higher prices. Then came the coronavirus and we got plunged into uncharted waters. Showings have decreased dramatically, but not stopped altogether. For example on Tuesday, March 31 there were 938 recorded tours on the scheduling platform ShowingTime while on Tuesday, March 10 we had 2,282 (for the 11 counties that make up Metro Denver, source: Megan Aller with First American).

The number of homes for sale increased to 5,776 when compared to February’s 4,835. In March 2019 we had 6,292 homes for sale. Days on market dropped to 29, similar to what happened this time last year. Appreciation was very strong in March 2020 with home with the average close pricing being 7.31 higher than March 2019. See our chart below comparing Q1 of 2019 to Q1 of 2020.

Q1 2019

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of Homes Sold | Avg. Sold Price Change YOY (Appreciation)

|

|

| Jan. 2019 | 39 | $508,016 | $350,176 | 2,915 | + 2.89 % |

| Feb. 2019 | 39 | $512,312 | $349,801 | 3,468 | + 0.66 % |

| Mar. 2019 | 31 | $530,897 | $360,875 | 4,488 | + 1.79 % |

Q1 2020

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of Homes Sold | Avg. Sold Price Change YOY (Appreciation)

|

|

| Jan. 2020 | 45 | $532,494 | $355,754 | 3,324 | + 3.98 % |

| Feb. 2020 | 39 | $544,054 | $368,936 | 3,835 | + 5.04 % |

| Mar. 2020 | 29 | $567,382 | $386,344 | 4,296 | + 7.31% |

Source: DMAR

For the first time in nine months we had a tick up in the monthly number of homes for sale, which is typical for this time of year.

The market was extremely active in February: 5,116 new homes hit the market and 4,621 went under contract. In March, we had 6,663 new listings and 4,992 homes went under contract.

Concerned Sellers

According to DMAR’s latest reporting, 625 Denver metro sellers withdrew their homes from the market the last two weeks of March. To communicate how high this number is, only 284 homes were pulled in January of 2020. While we can’t know the collective reason for this, we can assume some were due to sellers being fearful of a volatile stock market, unemployment rates, and worry surrounding stay-at-home orders as well as parties getting sick after touring a property.

Are Prices Going Down?

We have been getting that question a lot and so far that data says no. We actually saw the highest gains coming out of March 2020 out of the first quarter of 2020 as well as 2019 (see chart above for comparison).

The average price of a single-family home jumped to a new all time high: $567,382. According to DMAR “The average close price for all single-family homes and condos was $513,526 – setting a new record high and the first time the average close price for both segments [condos as well as single family homes] topped the half million dollar mark.”

The stay-at-home orders officially hit Denver on Tuesday, March 18 so April and May’s stats will also be an important indicator of what will happen to what was gearing up to be an incredibly hot spring season. But so far, prices have only gone up, and substantially at that. Unemployment, the stock market, interest rates and buyer confidence will all inevitably have a role to play in what happens to the housing market for the rest of the year.

How Usaj Realty is Adapting

At Usaj we are pivoting each and every day. We know our business is built entirely on relationships and we are dedicated to each and every one of our clients’ well-being and safety. Like all of us, we are watching the current situation closely as it evolves and remain 100% committed to assisting Denver home buyers and sellers with their real estate journey. If you have any questions or concerns, contact us today and we can talk more in-depth about your unique situation.

We as a company are fully operational, working with new and past clients and closing transactions all over metro Denver. We are taking full advantage of technology during this time and conducting contact-free appointments. Please email us at info@usajrealtystg.wpenginepowered.com to learn more.

A few ways we’ve changed our day-to-day operations over the past few weeks:

- We are conducting virtual buyer and seller consultations

- We are no longer hosting open houses

- We are no longer driving in the same car with our clients

- Inspectors are able to assist our clients with FaceTime walkthroughs

- We are completing transactions with no-contact methods such as curbside closings

- We’ve implemented the statewide COVID-19 Addendum to our contracts which permits a transaction to be extended in the case a seller or homebuyer is exposed or quarantined

- We are taking the utmost care to keep our clients safe and are following all of the latest CDC recommendations

- We are utilizing virtual tours, professionally made videos, social media videos, and FaceTime walk-throughs so that buyers don’t have to enter properties unless they believe it might be “the one” – this also helps give the seller peace of mind

Key takeaways for March 2020 via DMAR:

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

- Active Inventory in March 2020: 5,776

- February 2020: 4,835

- January 2020: 4,941

- December 2019: 5,037

- November 2019: 6,988

- October 2019: 8,557

- September 2019: 9,286

- August 2019: 9,350

- July 2019: 9,359

- June 2019: 9,520

- May 2019: 8,891

- April 2019: 7,012

- March 2019: 6,292

- February 2019: 6,017

- January 2019: 5,881

- December 2018: 5,577

- November 2018: 7,530

- October 2018: 8,539

- September 2018: 8,807

- August 2018: 8,228

- July 2018: 7,643

- June 2018: 7,436

- May 2018: 6,437

- April 2018: 5,160

- March 2018: 4,619

- February 2018: 4,084

- January 2018: 3,869

- December 2017: 3,854

- November 2017: 5,131

- October 2017: 6,312

- September 2017: 7,586

- August 2017: 7,360

- Median Sold Price for a condo in Denver metro in March 2020 was: $330,000

- February 2020: $315,000

- January 2020: $310,000

- December 2019: $308,788

- November 2019: $312,000

- October 2019: $306,875

- September 2019: $312,000

- August 2019: $310,000

- July 2019: $312,000

- June 2019: $310,000

- May 2019: $315,000

- April 2019: $305,000

- March 2019: $300,000

- February 2019: $297,500

- January 2019: $290,000

- December 2018: $298,225

- November 2018: $299,450

- October 2018: $299,250

- September 2018: $301,625

- August 2018: $299,000

- July 2018: $300,000

- June 2018: $305,000

- May 2018: $306,331

- April 2018: $297,000

- March 2018: $295,000

- February 2018: $296,000

- January 2018: $285,000

- December 2017: $285,000

- November 2017: $272,000

- October 2017: $275,000

- September 2017: $268,000

- August 2017 $275,000

- July 2017: $270,100

- Median Sold Price for a single-family residence in Denver metro in March 2020 was: $487,950

- February 2020: $469,900

- January 2020: $460,000

- December 2019: $450,000

- November 2019: $453,250

- October 2019: $456,000

- September 2019: $450,000

- August 2019: $459,900

- July 2019: $469,912

- June 2019: $465,000

- May 2019: $470,000

- April 2019: $460,000

- March 2019: $450,000

- February 2019: $430,100

- January 2019: $425,000

- December 2018: $430,000

- November 2018: $427,000

- October 2018: $435,000

- September 2018: $428,000

- August 2018: $445,000

- July 2018: $450,000

- June 2018: $452,500

- May 2018: $450,000

- April 2018: $455,000

- March 2018: $440,875

- February 2018: $435,000

- January 2018: $416,000

- December 2017: $415,000

- November 2017: $405,000

- October 2017: $415,000

- September 2017: $409,000

- August 2017: $410,000

- July 2017: $420,000

In the News: What’s Happening in Denver

‘This is just unprecedented’: Colorado unemployment applications skyrocket amid COVID-19 outbreak

“New numbers from the Colorado Department of Labor and Employment show a dramatic increase in people who have filed for assistance in the last few days as state and health officials shuttered businesses in an effort to slow the spread of the novel coronavirus.”

– Denver Business Journal

In the News: What’s Happening Nationally

Virtual, robot and solo home touring soar as social distancing hits the housing market amid coronavirus fear

“While homebuyer demand has plummeted, there are still some out there who may need to move, and either purchase or rent a home. So, much like all interaction in the age of COVID-19, home touring is moving online, using robots and going solo.

Zillow, a home listing site, said it saw a 191% increase in the creation of 3D home tours in the first weeks of March compared with the average number created in February. Even before the coronavirus, listings including a 3D Home tour were saved by users 50% more, and those homes sold on average 10% faster.”

FHA rolls out new mortgage relief options amid coronavirus outbreak

“With a record number of people suddenly unemployed due to the impact of the coronavirus on the nation, the government is taking steps to allow some borrowers to pause their mortgage payments for six months or longer.

The Department of Housing and Urban Development announced Thursday that the Federal Housing Administration is rolling out a ‘tailored set of mortgage payment relief options’ for FHA mortgage borrowers who are being affected by the coronavirus.

One of those payment relief options gives borrowers the ability to defer their mortgage payments for at least six months and as many as 12 months.”

Dollar strengthens, set for best week since the financial crisis

“The U.S. dollar is up about 3.5% against a basket of currencies through a week when investors have liquidated everything from stocks to bonds to gold and commodities. At its three-year peak of nearly 103 hit overnight, the dollar was up more than 5%, its biggest weekly gain since October 2008.”

– CNBC

Another financial crisis is brewing in the mortgage market

“Homeowners are protected by the FHFA directives. Mortgage servicers—the companies that collect payments from borrowers and disbursed the payment to investors in mortgage bonds—are still on the hook to pay investors, even if borrowers stop making payments. The company that handles payments can vary: it is either the bank or lender that issued the mortgage, or a separate company that specializes in servicing mortgages. Among those banks are the biggest in the country—Citi, JPMorgan Chase, Wells Fargo.”

– Curbed

Can the spring housing market be saved?

“So, what is COVID-19 going to do to the housing market’s spring selling season? That’s the March through June period when more than half of all U.S. home sales typically occur, as families with kids try to move before the start of the new school year in September.

Look for the peak of the housing market’s annual cycle to be delayed, not canceled, according to Lawrence Yun, chief economist of the National Association of Realtors.”

Report for March 2020:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!