April 2020: Denver’s Real Estate Trends Uncovered!

Fewer Homes Under Contract, Sold

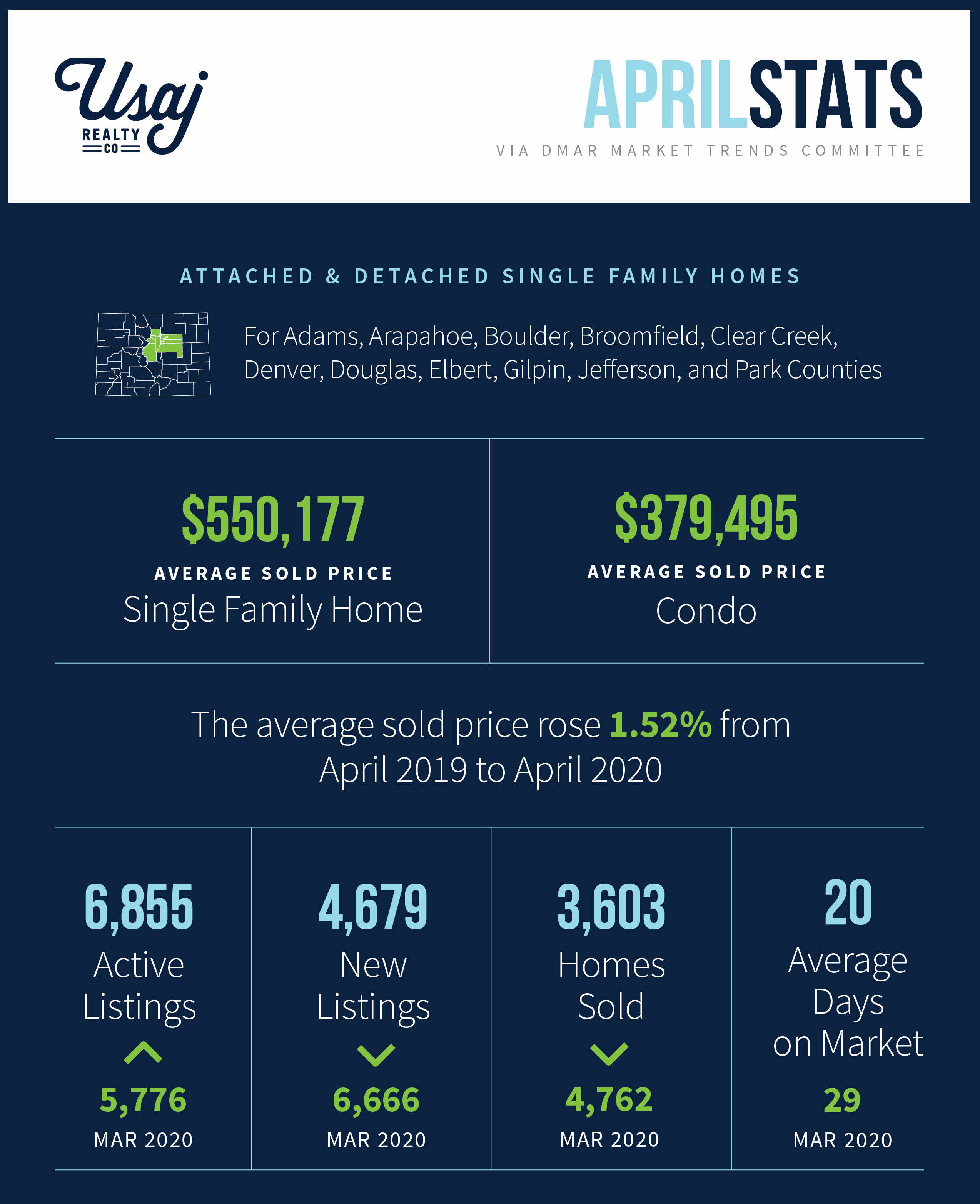

The real estate industry pivoted in many unprecedented ways in April 2020: homes went under contract without buyers ever seeing the place in person, realtors assisted clients entirely in a virtual manner, and videos and virtual tours became more important than ever before. However, even with all that flexibility and agility of buyers, sellers, and industry professionals, the sheer number of sold and newly under contract homes took a deep dive.

Showings of for sale homes were not allowed in Denver from April 8 – April 27, so it makes sense that we had a huge drop in under contract and sold listings during that time frame. According to ShowingTime, 3,500 showings were scheduled on April 27, the most we have had yet for a Monday in 2020 so it is clear there was some pent up demand and buyers were ready to get back out there (DMAR).

When compared to April 2019, the number of homes that went under contract was down 45.79 percent, new listings dropped 29.81 percent, and the number of homes sold dropped 30.78 percent (DMAR). Days on market dropped to 20, from 28 in April 2019 and 29 in March 2020, meaning that homes are selling much faster.

First 4 months of 2019

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of Homes Sold | Avg. Sold Price Change YOY | |

| Jan. 2019 | 39 | $508,016 | $350,176 | 2,915 | + 2.89 % |

| Feb. 2019 | 39 | $512,312 | $349,801 | 3,468 | + 0.66 % |

| Mar. 2019 | 31 | $530,897 | $360,875 | 4,488 | + 1.79 % |

| Apr. 2019 | 28 | $553,371 | $368,565 | 5,205 | +1.5 % |

First 4 months of 2020

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of Homes Sold | Avg. Sold Price Change YOY | |

| Jan. 2020 | 45 | $532,494 | $355,754 | 3,324 | + 3.98 % |

| Feb. 2020 | 39 | $544,054 | $368,936 | 3,835 | + 5.04 % |

| Mar. 2020 | 29 | $567,382 | $386,344 | 4,296 | + 7.31% |

| Apr. 2020 | 20 | $550, 177 | $379,495 | 3,603 | + 1.52 % |

Source: DMAR

Showings

As of May 4, Denver’s Department of Public Health had the following rules posted on their website.

Real Estate Showings/Closings may continue in Denver subject to the following provisions:

1) open houses are not permitted

2) properties must be vacant, with no one living there, unless the only occupant in the home is the owner and not a rental tenant

3) Social Distancing requirements must be followed at all times

4) all commonly-used surfaces must be wiped down and sanitized before and after the showings.

What’s Ahead for Denver’s Housing Market?

Unemployment in Colorado

Over 358,000 Coloradans have filed for unemployment, which will inevitably affect the overall economy of the state. According to the Colorado Sun, “The new numbers indicate that Coloradans have been losing their jobs at a fairly steady clip over the past five weeks with no signs of the damage slowing.”

Prices and Low Inventory

Denver is still a seller’s market for each price point except for homes over $1 million. And inventory is still very low with less than a 2 month supply for all homes priced between $200,000 – $749,000. While demand remains high and supply stays low, prices are not likely to see a big dip. According to DMAR, “Buyers received an average of 99.96 percent of their list price in April.” Prices did dip slightly compared to March but were up year-over-year.

Housing Inequality

The inequality gap is going to be widened across the country post-COVID, as some families are able to successfully sustain a steady income through telecommuting with access to things like high speed internet, and others are not. As income disparities grow, so will housing inequality. We were already experiencing an affordable housing crisis in Denver, and COVID is lamentably going to make matters worse.

Lending Restrictions Tighten

As the COVID pandemic goes on and on, costing tens of millions of Americans their jobs, lenders are worried Americans won’t be able to pay back their loans. According to Bankrate, “Mortgage lenders are battling economic uncertainty by raising minimum credit scores, requiring higher down payments, triple-checking employment status and even eliminating certain loan types altogether.”

Historically Low Interest Rates

DMAR notes that “according to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage hit a historical low of 3.23 percent on April 30…”

Many more unforeseen factors and repercussions will be felt during 2020 and beyond. What issue is concerning you and your family most right now? Leave us a comment below.

Key takeaways for April 2020 via DMAR:

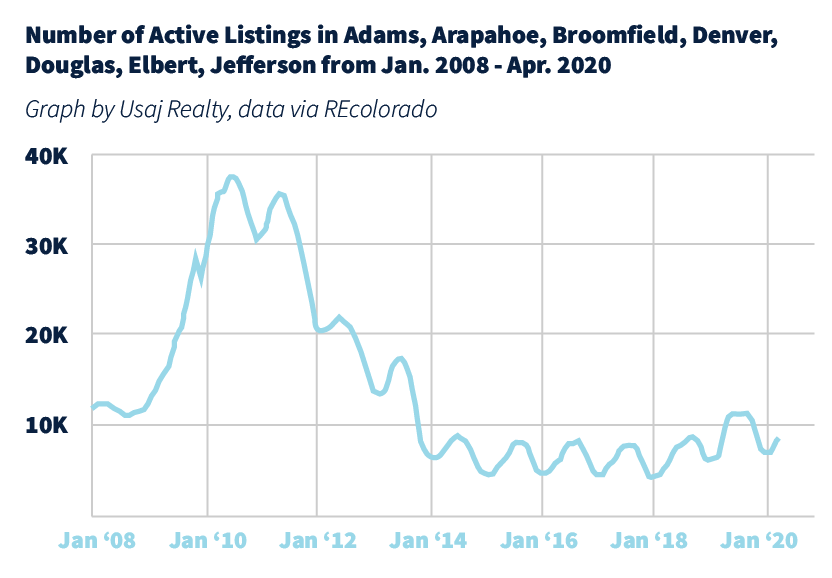

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

- Active Inventory in April 2020: 6,855

- March 2020: 5,776

- February 2020: 4,835

- January 2020: 4,941

- December 2019: 5,037

- November 2019: 6,988

- October 2019: 8,557

- September 2019: 9,286

- August 2019: 9,350

- July 2019: 9,359

- June 2019: 9,520

- May 2019: 8,891

- April 2019: 7,012

- March 2019: 6,292

- February 2019: 6,017

- January 2019: 5,881

- December 2018: 5,577

- November 2018: 7,530

- October 2018: 8,539

- September 2018: 8,807

- August 2018: 8,228

- July 2018: 7,643

- June 2018: 7,436

- May 2018: 6,437

- April 2018: 5,160

- March 2018: 4,619

- February 2018: 4,084

- January 2018: 3,869

- December 2017: 3,854

- November 2017: 5,131

- October 2017: 6,312

- September 2017: 7,586

- August 2017: 7,360

- Median Sold Price for a condo in Denver metro in April 2020: $322,000

- March 2020: $330,000

- February 2020: $315,000

- January 2020: $310,000

- December 2019: $308,788

- November 2019: $312,000

- October 2019: $306,875

- September 2019: $312,000

- August 2019: $310,000

- July 2019: $312,000

- June 2019: $310,000

- May 2019: $315,000

- April 2019: $305,000

- March 2019: $300,000

- February 2019: $297,500

- January 2019: $290,000

- December 2018: $298,225

- November 2018: $299,450

- October 2018: $299,250

- September 2018: $301,625

- August 2018: $299,000

- July 2018: $300,000

- June 2018: $305,000

- May 2018: $306,331

- April 2018: $297,000

- March 2018: $295,000

- February 2018: $296,000

- January 2018: $285,000

- December 2017: $285,000

- November 2017: $272,000

- October 2017: $275,000

- September 2017: $268,000

- August 2017 $275,000

- July 2017: $270,100

- Median Sold Price for a single-family residence in Denver metro in April 2020 was: $475,425

- March 2020: $487,950

- February 2020: $469,900

- January 2020: $460,000

- December 2019: $450,000

- November 2019: $453,250

- October 2019: $456,000

- September 2019: $450,000

- August 2019: $459,900

- July 2019: $469,912

- June 2019: $465,000

- May 2019: $470,000

- April 2019: $460,000

- March 2019: $450,000

- February 2019: $430,100

- January 2019: $425,000

- December 2018: $430,000

- November 2018: $427,000

- October 2018: $435,000

- September 2018: $428,000

- August 2018: $445,000

- July 2018: $450,000

- June 2018: $452,500

- May 2018: $450,000

- April 2018: $455,000

- March 2018: $440,875

- February 2018: $435,000

- January 2018: $416,000

- December 2017: $415,000

- November 2017: $405,000

- October 2017: $415,000

- September 2017: $409,000

- August 2017: $410,000

- July 2017: $420,000

In the News: What’s Happening in Denver

Real Estate 2020: Questions Denver Buyers and Sellers Should Be Asking Right Now

At press time in early April, it was too soon to say how everything from stay-at-home orders to the economic impact of layoffs might affect the market long-term. “Clearly we are in unprecedented times,” says Usaj Realty’s Megan Ivy. But, she adds, “even now, buyers are buying and sellers are selling and we have [more] people in the pipeline to resume those activities.” Many aspects of the real estate market were deemed essential, and others have adjusted. For instance, real estate closings in Colorado require “wet signatures,” meaning that a buyer and seller can’t e-sign, so title companies had to improvise and started offering drive-by and contactless options to close deals. So, in summary, the market keeps moving—albeit at a slower pace.

COVID-19: Seven Ways It Will Change Denver’s Housing Market

#5: Housing inequality will grow – “Uneven growth in housing costs has exacerbated income inequality in the U.S. since the Great Recession. Since 2008, the bottom 10 percent of earners have seen their housing costs rise, while the richest quarter of the population has actually seen their housing costs fall. The pandemic’s economic effects are likely to accelerate this trend. Over the next two years, higher earners will take advantage of low borrowing costs for refinancing and abundant luxury rental inventory, while lower-income households will struggle with economic uncertainty and even greater competition for an already tight inventory of affordable housing.”

– Westword

Another 79,000 Coloradans Filed for Unemployment Last Week, Bringing Coronavirus Total to More Than 350,000

“Colorado has seen a surge in unemployment claims as social distancing measures shuttered restaurants, ski resorts and other businesses in mid March… Starting the week ended April 25, Colorado began processing claims for self-employed, independent contractors and gig workers. With federal pandemic unemployment benefits of $600 a week, this was the first time such workers were allowed to collect unemployment pay.”

In the News: What’s Happening Nationally

The Coronavirus Pandemic is Worsening the US Housing Crisis — and Could Lead to Greater Inequality

“Even as almost all Americans are told to remain at home, millions are now unemployed and must scramble to figure out how to pay for that home. The irony is that the one thing Americans are told to do is preventing many of them from doing the one thing they need to do. The pandemic is exacerbating the affordable housing crisis that plagues cities throughout the US and contributes to rising inequality, housing insecurity, and homelessness…For those already struggling to stay in their homes, the coronavirus is a dramatic blow to an already difficult situation. Even for those families who have received some temporary relief for April and May, it is hard to imagine how families that already pay between 30% and 50% of their salary on rent will be able to pay off any debts when relief programs expire.”

Nearly 3 Million Borrowers are Already in Forbearance

“The issue of growing forbearance demonstrates the need for a solution for mortgage servicers that are required to advance principal and interest payments to investors on loans that are in forbearance.”

A Quarter of Realtors® This Week Report Homes Coming Under Contract Without Buyers First Visiting the Property

“A quarter of Realtors® with clients putting contracts on homes this week had at least one do so without physically seeing the property, according to a new survey from the National Association of Realtors®. For those clients, the median amount of homes toured – either virtually or in person – before putting a contract on a home was just three. NAR’s 2019 Profile of Home Buyers and Sellers found buyers typically looked at nine homes before placing a contract on a home.”

– National Association of Realtors

How Housing Choices For Millennials Could Change In A Post-Coronavirus World

“The sectors of the new home market that are getting hit the worst in this economic downturn are the ends of the barbell: high end and entry level. The entry level is getting the ball pulled away because of layoffs, lost income, and anxiety about the future….In a post-virus world, we could see a further surge in the relative popularity of single-family homes among renters. Whereas in an apartment building, where tenants are in closer contact by necessity, sometimes packed into elevators to get to their floor, a detached home allows for much easier social distancing. This could accelerate a shift that was already occurring.”

– Forbes

Here’s How Long it has Taken for Bear Market Losses to Recover

“If history is any guide — and, as the disclaimer always goes, the past isn’t any guarantee of the future — it will take a long time before investors are made whole again and reach the point where they were before the things got ugly. According to a research note from Bank of America Securities, it has taken 1,100 trading days on average to regain the territory lost during a bear market. There are 252 trading days in a year, so that means the average time to get back to where we were is 4.4 years.”

Report for April 2020:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!