September 2021: Denver’s Hot Real Estate Market Trends

Prices are up but waiting to buy could cost you

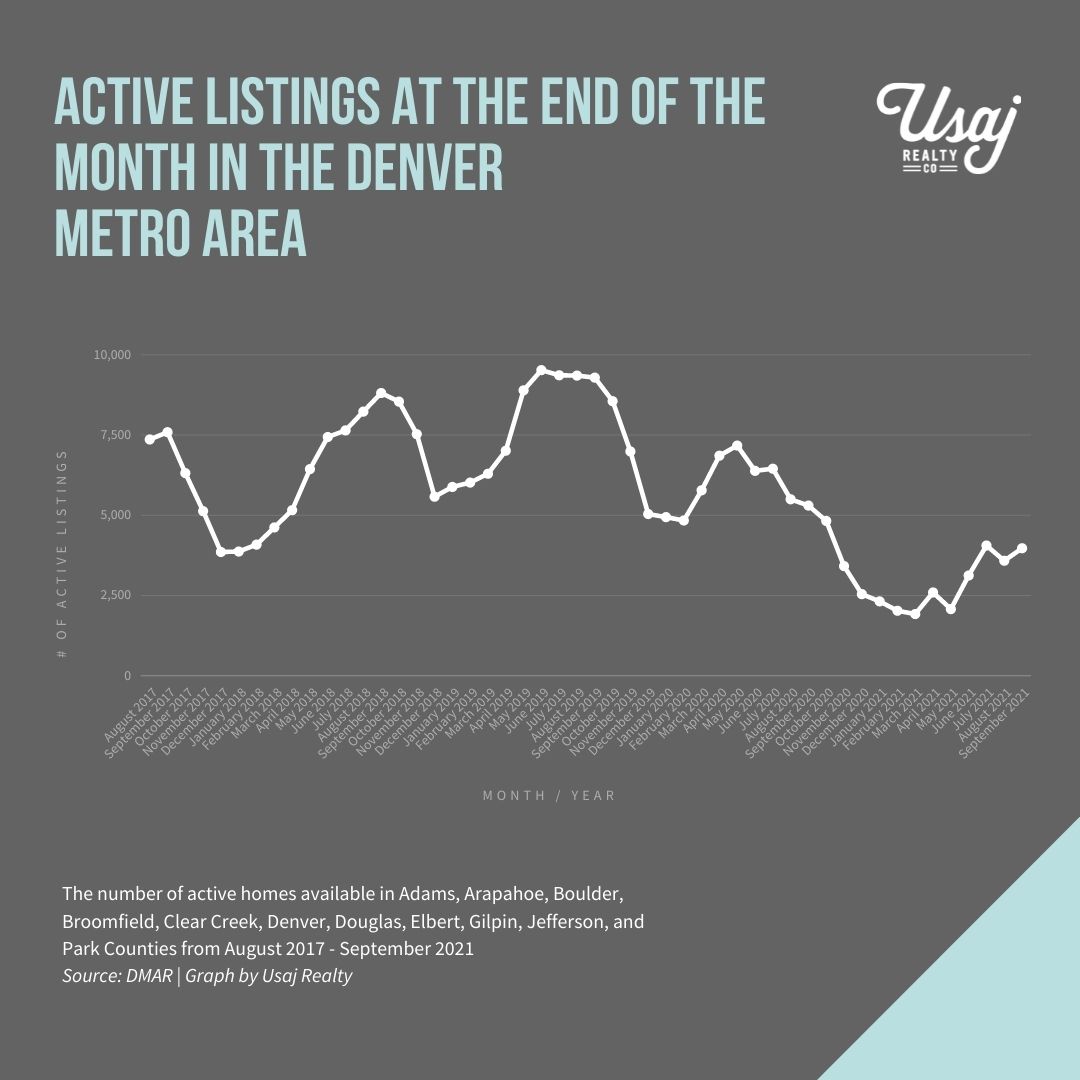

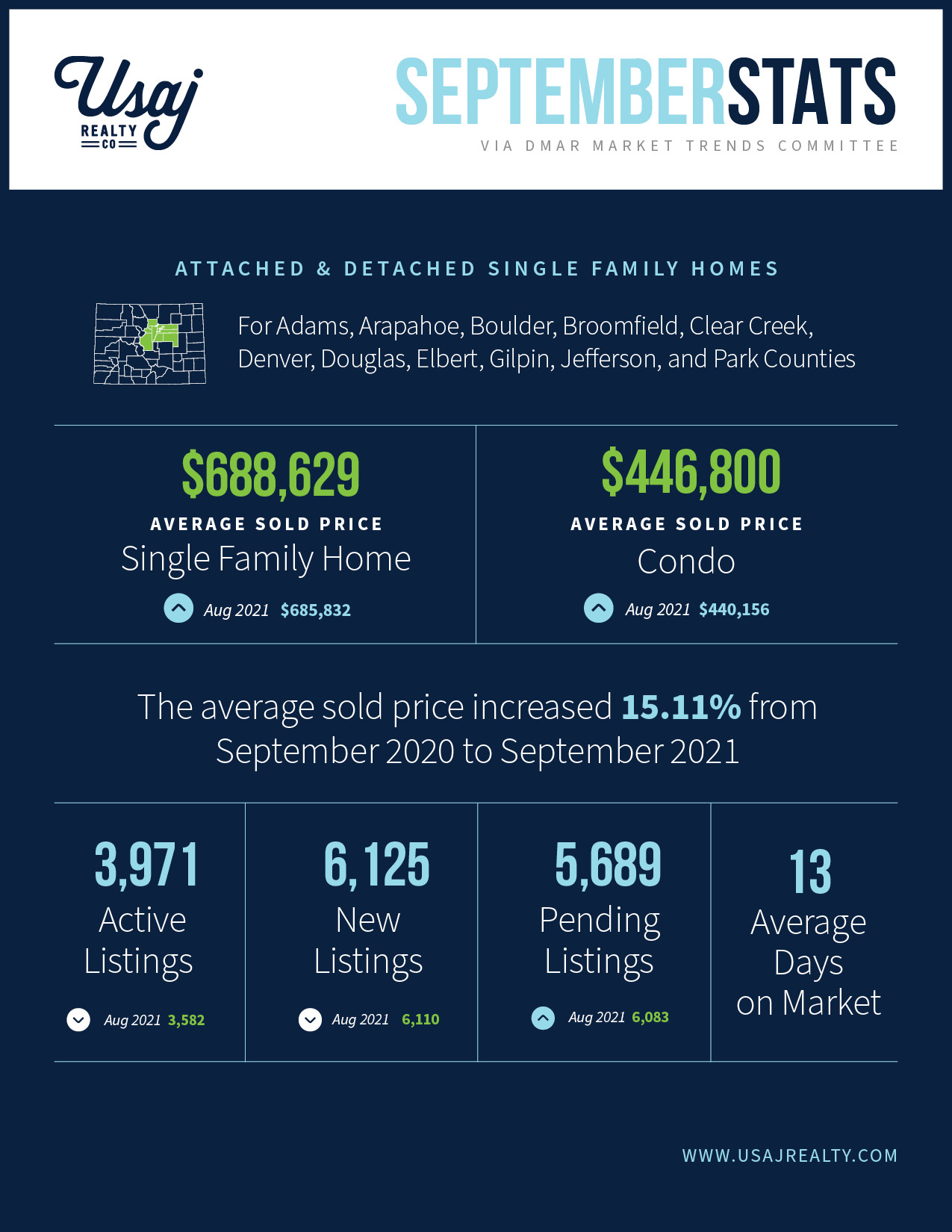

DMAR’s numbers from September 2021 are out and many important figures are up this month: prices, days on market, and inventory. The average price of a single-family detached home is currently $688,629 an increase of $90,762 from September 2020. Active listings are down 25.09% from last year but up 10.86% from August.

Fall is a great time to consider buying a home with more properties to choose from, an increase in the days on market, home prices unlikely to drop anytime soon, and the expectation that interest rates may rise before the end of the year.

According to DMAR, “months of inventory increased to 0.76. While this may not feel like a huge increase, it gives buyers a bit more options.” So what’s next for home buyers and sellers?

Experts are predicting that mortgage rates will increase soon and that we will see home prices appreciate more modestly in 2022. In Colorado, year-to-date, the average home sale price has gone up a whopping +23.6% percent, so it very well could be in the 10 percent range next year. With higher interest rates and higher prices coupled together, it is likely to increase monthly payments for someone who buys a home today versus several months from now. The DMAR Chair of the Market Trends Committee puts it directly: “Word of advice: jump into the real estate market now. Those who wait will (literally) pay for it.”

A quick look at what happened in September:

- Denver metro’s active listings available at the end of the month declined by 25.09% over last year

- The September median sale price was $530,000, up 15.22% from last year

- The average home spent 13 days on the market during September, 10 fewer days than the same time last year

- The average price of a single-family detached home is currently $688,629 an increase of $90,762 from the same period a year ago

September Numbers Over the Years:

| Avg. Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of New Listings | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Sept. 2017 | 32 | $476,051 | $313.096 | 5,842 | 4,427 | 5,178 | + 8.84 % |

| Sept. 2018 | 26 | $502,034 | $347,629 | 5,953 | 3,983 | 4,597 | + 6.83 % |

| Sept. 2019 | 33 | $535,032 | $357,500 | 6,038 | 4,506 | 5,343 | + 6.06 % |

| Sept. 2020 | 23 | $599,418 | $384,397 | 6,456 | 5,850 | 6,376 | +12.14 % |

| Sept. 2021 | 13 | $688,629 | $446,800 | 6,125 | 5,233 | 5,689 | + 15.11 % |

Source: DMAR

Average Interest Rates by Year in Denver

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Average Interest Rate | 5 % | 4.7 % | 4.4 % | 3.6 % | 4 % | 4.2 % | 3.8 % | 3.7 % | 4 % | 4.6 % | 3.9 % | 3.1 % |

Data courtesy of Megan Aller | First American Title

During these unprecedented times, Usaj Realty would love to carefully assist you with finding your next place to call home, or selling your current property. Our acumen, attention to the market, and negotiation skills will all go to work in order to advocate for your goals. Email us at info@usajrealtystg.wpenginepowered.com or call 720.398.2999. We measure our success by the happiness of our clients!

Headlines: What’s Happening in Colorado

Denver’s embrace of rezoning for “granny flats” is growing by neighborhood, individual initiative

“Interest in ADUs rose steadily in the 2010s, and has only grown stronger in the past few years as the metro-wide real estate market became, for many, prohibitively expensive. City planners have seen an uptick in people moving to rezone their property, and in 2019 carved out a place for ADUs in Blueprint Denver — a “planned guidance” document that recommends removing barriers to the units in residential districts. So far, planners say, they’re not aware that any requests have been denied.”

— Colorado Sun

Rising Front Range rents are widespread and will keep climbing

“For metro Denver as a whole, rents are up 14.4% year-over-year in August and they are up 12.8% since the pandemic arrived in March 2020, according to the Apartment List September Rent Report, which tracks the changes in the rents charged for the same apartments over time.”

— The Denver Post

Headlines: What’s Happening Nationally

Homeowners gain $2.9 trillion in equity in Q2 2021

“Homeowners with mortgages gained $2.9 trillion in equity in the second quarter of 2021, a 29.3% year-over-year increase, according to a new report by CoreLogic released last Wednesday. This marks an average gain of $51,500(!) per borrower since the second quarter of 2020.”

— Housing Wire

Mortgage rates are heading higher as Fed plans bond taper

“The average rate for a 30-year fixed mortgage probably will rise to 3.1% in the final three months of 2021 from 2.8% in the prior quarter, according to a forecast by Mortgage Bankers Association on Sept. 21. That would be the highest since 2020’s second quarter, in the opening weeks of the Covid-19 pandemic.”

— Forbes Advisor

Fed is meeting as inflation slows—what that means for mortgage rates

“Most economists agree that mortgage rates will end 2021 in the low 3% range. However, that’s where the agreement ends. Some experts think rates will jump above 4% next year while others are expecting a more modest increase in 2022. Here’s what economists are saying:

- The Mortgage Bankers Association predicts long-term rates to hit 4% by 2022 and top out at around 4.3% by the end of next year.

- PNC expects the 30-year fixed mortgage rate to increase from around 3.05% currently to around 3.2% by the end of this year, and 3.4% by the end of 2022.

- Freddie Mac forecasts the 30-year fixed mortgage to hit 3.4% by the fourth quarter of 2021 and 3.7% by the end of 2022.

- The National Association of Realtors (NAR) predicts rates will get to 3.3% by the end of 2021 and average 3.6% in 2022.”

— Forbes Advisor

Report for September 2021:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!

Whether buying or selling, Usaj Realty is dedicated to helping you stay competitive. Your Usaj Realty broker will communicate effectively, learn your goals like the back of their hand, and work closely with you to negotiate the best terms possible, and expertly manage your transaction from start to finish, ensuring peace of mind.

Email us at info@usajrealtystg.wpenginepowered.com or call 720.398.2999