Far Fewer Homes Sold Due to April’s Lack of Contracts, But Pending Homes and New Listings Skyrocketed in May 2020

It appears that while April’s stay-at-home ordinance tapered the number of pending transactions down to just over 3,000, May picked up right around where 2019 numbers were.

In April, Denver metro had an unseasonably low number of homes go under contract (3,280) which directly impacted May’s number of closings. The number of homes that went under contract jumped to 6,809 in May which is even higher than May 2019’s number of 6,470. Additionally, the number of new listings increased by 36 percent month-over-month.

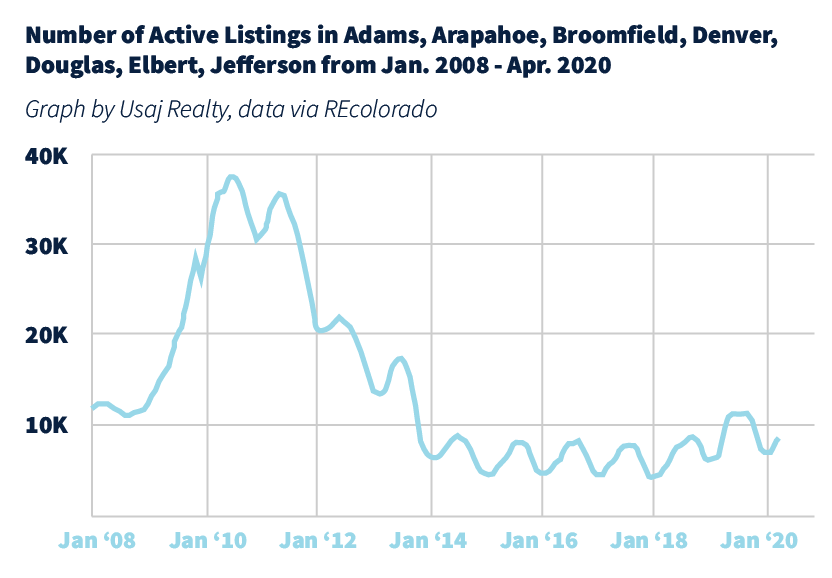

Furthermore, we are still seeing the close-to-list price continue to hover at 99 percent, indicating when a property is priced well, buyers are purchasing right at list price. Denver is still a seller’s market for all price ranges under $1 million. Inventory increased month-over-month, however, numbers show we are still lagging behind compared to years past. We had a 19.36 percent fewer homes for sale in May 2020 than we did in May 2019.

As interest rates remain incredibly low, global stocks return to their March levels, and consumer confidence continues to strengthen, there is reason to be hopeful that the housing market could stabilize. However, rising rates of unemployment, lending challenges, global economic volatility, and the housing shortage could all play a role in disrupting the trends we have seen over the past decade. The coming months will determine how the market is shifting and how much it will change from years past.

First 5 months of 2019

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Jan. 2019 | 39 | $508,016 | $350,176 | 2,915 | 4,008 | + 2.89 % |

| Feb. 2019 | 39 | $512,312 | $349,801 | 3,468 | 4,443 | + 0.66 % |

| Mar. 2019 | 31 | $530,897 | $360,875 | 4,488 | 5,448 | + 1.79 % |

| Apr. 2019 | 28 | $553,371 | $368,565 | 5,205 | 6,470 | +1.5 % |

| May 2019 | 24 | $555,482 | $380,363 | 6,164 | 6,470 | +3.36 % |

First 5 months of 2020

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Jan. 2020 | 45 | $532,494 | $355,754 | 3,324 | 4,923 | + 3.98 % |

| Feb. 2020 | 39 | $544,054 | $368,936 | 3,835 | 5,083 | + 5.04 % |

| Mar. 2020 | 29 | $567,382 | $386,344 | 4,296 | 4,992 | + 7.31% |

| Apr. 2020 | 20 | $550, 177 | $379,495 | 3,603 | 3,280 | + 1.52 % |

| May 2020 | 23 | $543,072 | $368,241 | 3,152 | 6,809 | – 1.31 % |

Source: DMAR

Housing Market | Sold Prices in Metro Denver:

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

{{cta(‘306f76cc-bb61-4b78-84f6-7ea5feb5e301’)}}

Headlines: What’s Happening in Denver

Certain Aspects Of Colorado Housing Market Affected By Coronavirus

“Realtors preparing for the summer housing market say the first two months of the COVID-19 pandemic have yet to impact sales and prices, but change could be delayed. They advise buyers and sellers to prepare for similar conditions before the coronavirus with some newer trends that may stick around in the months ahead.”

– CBS4

Denver’s eviction moratorium will stay in place ‘until further notice’

“A statewide moratorium on evictions ends in 15 days, but Denver will continue on with its own moratorium on evictions.

Mayor Hancock said in March that Denver sheriffs deputies would be redeployed away from evictions indefinitely, adding that people should not be evicted during the coronavirus outbreak. Erika Martinez, a city spokeswoman, said in an email Thursday that ‘Denver’s order will not expire on May 31. It will stay in place until further notice.'”

Coronavirus Poured A Lot Of Cold Water On Denver’s Once-Hot Housing Market

“The pandemic hit the luxury segment particularly hard. High-end buyers have seen declines in their stock holdings and tighter lending standards for large mortgages, according to the realtor association. Prices for homes priced at $1 million and above were down 33 percent compared to the previous month and 1 percent from a year ago, the report found.”

–CPR

Ranked: The 10 US Cities Best Positioned To Recover From Coronavirus (And The 10 Worst)

“Cities that were fast-growing pre-coronavirus will continue their rise. “Denver and Salt Lake City are well-positioned to retake their crown as two of the fastest-rising metro areas in the US,” says Kamins.

– Forbes

Headlines: What’s Happening Nationally

U.S. consumer confidence stabilizes; new home sales surprise

“The worst may be over for the economy,” said Chris Rupkey, chief economist at MUFG in New York. “We still can’t see a V-shaped recovery, but at least this is looking like the shortest recession in history which will be measured in months not years.”

– Reuters

Impact of COVID-19 on Real Estate Showings

“The initial drop in showing activity experienced throughout much of the country in the early weeks of the COVID-19 pandemic has given way to modest signs of stabilization. Through mid-March, year-over-year showing activity was higher nationwide compared to 2019. The current volume is indicative of the industry’s response to COVID-19, which is changing daily.”

The coronavirus pandemic continued its historic assault on the domestic and global economy in April, and the housing market did not go unscathed. Typically, the hot spring home-buying season would be in full swing in April, but pandemic-related impacts, including shelter-in-place orders, the rapid surge in unemployment, and declining consumer confidence chilled a promising spring for the housing market.”

30-Year Fixed Rate Mortgage Average in the United States

On May 28, 2020 the averages 30 year fixed rate mortgage in the U.S. was 3.15 percent. See the latest from FRED’s graph here: https://fred.stlouisfed.org/series/MORTGAGE30US

– Federal Reserve Bank of St. Louis

Consumer confidence rises unexpectedly in May as economy reopens

“Consumer confidence unexpectedly improved in May as the U.S. economy slowly restarted, according to data released Tuesday by The Conference Board. The business group’s consumer confidence index rose to 86.6 this month from 85.7 in April. Economists polled by Dow Jones expected consumer confidence of 82.3 in May.”

– CNBC

Report for May 2020:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!