Denver Real Estate Market Report for July 2019

See below for our full report for July 2019 and please let us know if you have any questions. We email this market infographic report on the Denver Real Estate Market each month. To get on the email list, please reach out to info@usajrealty.com and request to be added.

Update on the Denver Housing Market

As wages in Denver continue to steadily increase, inflation on housing (buying and renting) is slowing in comparison to years past. Year-over-year, July’s average home prices went up 4.27 percent. Many argue that the root cause of a slowing housing market is that home prices have skyrocketed (especially for entry-level homes) to unobtainable levels, deterring buyers from jumping into homeownership. Nationally, the 2019 spring season had some of the slowest for sales in the past five years, according to CoreLogic Inc.

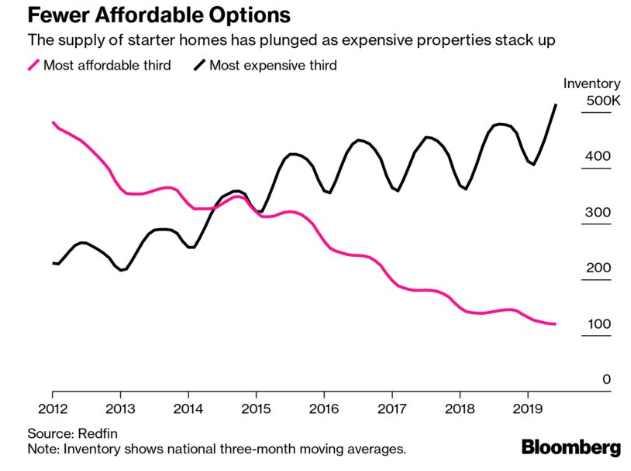

Affordability Crisis in Denver and Nationwide

With low borrowing costs, a healthy job market, and the longest recorded economic expansion on record, it would be easy to assume that the housing market nationwide would be booming. Taking a quick look at Denver’s affordable housing stock by price point brings another factor to light. In July, more single-family homes priced between $300,000 – $399,999 sold (979) than came newly available to the market (939). This leaves us with a less than a 1 month supply for all of Metro Denver (which includes Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson and Park counties) for single-family homes. This means if no new homes hit the market, it would take less than 1 month to completely sell out of all available listings priced from $300K – $399. As the price point increases, inventory also goes up — but affordability goes down.

Inventory in Denver had been creeping up for 6 months straight but did take a slight dip in July with 9,520 active listings. We are still in a sellers’ market with 1.73 months of inventory across the board. The Federal Reserve’s decision to drop interest rates by .25 percent last week may also have an effect on the rest of the market for 2019. If you are weighing the pros and cons of buying or selling this year, a Usaj Realty broker would be happy to assist you in expertly navigating the Denver market. Many factors go into deciding what could be right for your particular situation, so sitting down with an expert can be a great opportunity to discover the best route for you.

Key takeaways for July 2019 via DMAR:

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

- Active Inventory in July 2019: 9,359

- June 2019: 9,520

- May 2019: 8,891

- April 2019: 7,012

- March 2019: 6,292

- February 2019: 6,017

- January 2019: 5,881

- December 2018: 5,577

- November 2018: 7,530

- October 2018: 8,539

- September 2018: 8,807

- August 2018: 8,228

- July 2018: 7,643

- June 2018: 7,436

- May 2018: 6,437

- April 2018: 5,160

- March 2018: 4,619

- February 2018: 4,084

- January 2018: 3,869

- December 2017: 3,854

- November 2017: 5,131

- October 2017: 6,312

- September 2017: 7,586

- August 2017: 7,360

- Median Sold Price for a condo in Denver metro in July 2019 was: $312,000

- June 2019: $310,000

- May 2019: $315,000

- April 2019: $305,000

- March 2019: $300,000

- February 2019: $297,500

- January 2019: $290,000

- December 2018: $298,225

- November 2018: $299,450

- October 2018: $299,250

- September 2018: $301,625

- August 2018: $299,000

- July 2018: $300,000

- June 2018: $305,000

- May 2018: $306,331

- April 2018: $297,000

- March 2018: $295,000

- February 2018: $296,000

- January 2018: $285,000

- December 2017: $285,000

- November 2017: $272,000

- October 2017: $275,000

- September 2017: $268,000

- August 2017 $275,000

- July 2017: $270,100

- Median Sold Price for a single-family residence in Denver metro in July 2019 was: $469,912

- June 2019: $465,000

- May 2019: $470,000

- April 2019: $460,000

- March 2019: $450,000

- February 2019: $430,100

- January 2019: $425,000

- December 2018: $430,000

- November 2018: $427,000

- October 2018: $435,000

- September 2018: $428,000

- August 2018: $445,000

- July 2018: $450,000

- June 2018: $452,500

- May 2018: $450,000

- April 2018: $455,000

- March 2018: $440,875

- February 2018: $435,000

- January 2018: $416,000

- December 2017: $415,000

- November 2017: $405,000

- October 2017: $415,000

- September 2017: $409,000

- August 2017: $410,000

- July 2017: $420,000

In the News: What’s Happening in Denver

Denver is now a buyers’ market—at least for luxury condos

“Denver is building its way out of the housing crisis—at least for those who can afford luxury condos. The latest Denver Metro Association of Realtors report shows there is now 5.6 months of inventory of attached units worth between $750,000 and $1 million, meaning with Denver’s supply and the current rate of purchasing, it would take that long for every luxury condo on the market now to sell.” – 5280 Magazine

Denver ranks high among U.S. cities with profitable businesses

“Denver ranks among the top U.S. cities when it comes to its share of profitable businesses. The city ranks No. 5 out of 50 U.S. metro areas reporting the largest share of profitable businesses, according to a new report from online lending marketplace LendingTree. According to the report, 69.37% of businesses in Denver recorded a profit, against 15.35% that recorded losses.” – Denver Business Journal

Pay increases of 3.1 percent expected in metro Denver next year

“Pay increases in metro Denver and Boulder are expected to average 3.1 percent for the third year in a row, according to an annual compensation survey from the Employers Council…Those counting on a super-tight labor market to send pay skyrocketing will have to keep on waiting. But metro Denver residents may finally get a break this year and next — wages gains that finally outpace the rise in housing costs.

As wage gains hold steady, inflation is slowing, including housing. Apartment rents in metro Denver rose 2.4 percent in the second quarter on an annual basis, according to the Apartment Association of Metro Denver. The median price of a home sold in metro Denver was up 2.3 percent in June from a year ago, according to the Denver Metro Association of Realtors.” – The Denver Post

Metro Denver apartment rents grow at slowest rate in 8 years

“Rents continue to rise in metro Denver, but at a slower pace than previous years, according to the latest quarterly report from the University of Denver Daniels College of Business, which tracks apartment vacancy and monthly rental rates.” – Denver Business Journal

In the News: What’s Happening Nationally

The Fed Just Cut Interest Rates. Here’s What That Means for You

“The effect is not always direct or immediate, so consumers probably will not wake up on Thursday to find that all of their favorite rates have changed by a quarter of a point. There is even solid evidence that the mere expectation that the Fed would cut rates on Wednesday had already pushed down some of the key rates that consumers pay.” – New York Times

America’s housing affordability crisis spreads to the heartland

“Low mortgage rates and thriving employment should be the recipe for a strong housing market. Instead, they’re deepening America’s affordability crisis. What began on the coasts, in areas like New York and San Francisco, is now radiating into the nation’s heartland, as well as to cities from Las Vegas to Charleston, South Carolina. Entry-level buyers are scrambling to purchase homes that are in short supply, sending values soaring.” – Bloomberg

Economists say 2020 recession likely, but housing market won’t be the cause

“According to a panel of more than 100 housing experts and economists, the next recession is expected to hit in 2020. A few even said it may begin later in 2019, while another substantial portion predict that a recession will occur in 2021. But unlike last time, the housing market won’t be the cause. Trade policy, a geopolitical crisis and/or a stock market correction were the identifying factors found by the panelists to cause the recession. But that doesn’t mean that housing will be immune to the effects of a recession.” – Housingwire

Report for July 2019:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!